Are You Compliant with Your Payment Services Account Information?

Published

Some Blackbaud Merchant Services™ customers will receive communications asking to update critical signatory information within their Blackbaud Merchant Services account.

Understanding Compliance for “Know Your Customer” Regulations:

In compliance with global financial regulations aimed at preventing fraud and money laundering, Blackbaud regularly audits and reviews Blackbaud Merchant Services accounts. As a dedicated payment processor, we are committed to adhering to these legal requirements. To maintain compliance, we need to periodically send requests to our customers to update their account information. It is important for customers to respond promptly to these requests, as any delay in updating the required information could lead to temporary interruptions in payment processing services.

In the coming weeks, many Blackbaud Merchant Services customers, primarily in the United States, will receive important communications related to financial compliance. These notices will prompt action to update the data signatory information within your account(s). This update is needed for compliance purposes by federal banking laws and falls under the “Know Your Customer” (KYC) data requirements.

Navigating KYC Compliance:

The requirement for updated KYC data is in adherence to the The Bank Secrecy Act and the Customer Due Diligence Rule, established by the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury.

It's imperative to complete these updates by the deadline of April 30, 2024, to ensure compliance and continued smooth operation of payment services.

These compliance laws were designed to promote financial transparency and prevent illegal financial activities. For Blackbaud, this compliance effort underscores a commitment to upholding the highest standards of service integrity and security.

What Personal Information is Required?

Some of the personal information requirements include the full legal name, date of birth, Social Security number, and home address of an individual who either exercises significant control over the organization or holds an ownership stake of 25% or more. These roles normally include board members, executive directors, or finance directors.

How Can I Update This Information? A Step-by-Step Guide:

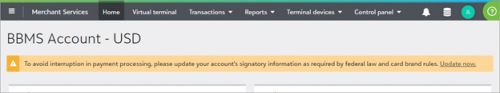

To help you avoid interruption in payment processing, if your account is missing required information, the Blackbaud Merchant Services Web Portal home page now displays an alert. From the alert, select Update now and provide required information.

Not seeing this alert? You must be signed in as an Environment or Solution Admin, or you must be assigned a role that grants you the ability to manage Blackbaud Merchant Services account info.

The deadline to update your signatory information within Blackbaud Merchant Services is April 30, 2024.

Note: If your organization has multiple merchant accounts, it’s important for you to update each account's information individually to avoid service interruptions. This mandate is not merely a Blackbaud policy but a legal obligation to ensure continued payment processing capabilities for Blackbaud Merchant Services accounts.

Conclusion: Upholding Financial Integrity:

The proactive update of KYC data within Blackbaud Merchant Services accounts is crucial for maintaining uninterrupted and compliant payment processing services. This initiative is reflective of an overarching commitment to financial security and operational transparency, which are vital to your organization's success.

With the April 30, 2024, deadline approaching, timely action is essential to ensure smooth and compliant financial operations.

For assistance or more information, please visit our Knowledgebase article.

In compliance with global financial regulations aimed at preventing fraud and money laundering, Blackbaud regularly audits and reviews Blackbaud Merchant Services accounts. As a dedicated payment processor, we are committed to adhering to these legal requirements. To maintain compliance, we need to periodically send requests to our customers to update their account information. It is important for customers to respond promptly to these requests, as any delay in updating the required information could lead to temporary interruptions in payment processing services.

In the coming weeks, many Blackbaud Merchant Services customers, primarily in the United States, will receive important communications related to financial compliance. These notices will prompt action to update the data signatory information within your account(s). This update is needed for compliance purposes by federal banking laws and falls under the “Know Your Customer” (KYC) data requirements.

Navigating KYC Compliance:

The requirement for updated KYC data is in adherence to the The Bank Secrecy Act and the Customer Due Diligence Rule, established by the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury.

It's imperative to complete these updates by the deadline of April 30, 2024, to ensure compliance and continued smooth operation of payment services.

These compliance laws were designed to promote financial transparency and prevent illegal financial activities. For Blackbaud, this compliance effort underscores a commitment to upholding the highest standards of service integrity and security.

What Personal Information is Required?

Some of the personal information requirements include the full legal name, date of birth, Social Security number, and home address of an individual who either exercises significant control over the organization or holds an ownership stake of 25% or more. These roles normally include board members, executive directors, or finance directors.

How Can I Update This Information? A Step-by-Step Guide:

To help you avoid interruption in payment processing, if your account is missing required information, the Blackbaud Merchant Services Web Portal home page now displays an alert. From the alert, select Update now and provide required information.

Not seeing this alert? You must be signed in as an Environment or Solution Admin, or you must be assigned a role that grants you the ability to manage Blackbaud Merchant Services account info.

The deadline to update your signatory information within Blackbaud Merchant Services is April 30, 2024.

Note: If your organization has multiple merchant accounts, it’s important for you to update each account's information individually to avoid service interruptions. This mandate is not merely a Blackbaud policy but a legal obligation to ensure continued payment processing capabilities for Blackbaud Merchant Services accounts.

Conclusion: Upholding Financial Integrity:

The proactive update of KYC data within Blackbaud Merchant Services accounts is crucial for maintaining uninterrupted and compliant payment processing services. This initiative is reflective of an overarching commitment to financial security and operational transparency, which are vital to your organization's success.

With the April 30, 2024, deadline approaching, timely action is essential to ensure smooth and compliant financial operations.

For assistance or more information, please visit our Knowledgebase article.

News

Community News

02/06/2024 10:00am EST

Leave a Comment