Blackbaud CRM: Now With Credit Card Updater

You’ve been there right? An alert comes in from your credit card company regarding a suspicious transaction. You know immediately it was not yours. You become instantly anxious thinking of the impending hassle the card compromise and a new credit card will cause you. If you haven’t been there, consider yourself lucky, but I’m willing to bet you have at least one close friend or family member who has.

For me that someone was my mother, who got the call that she was among one of the 17.2 million Target breach customers at perhaps the least opportune time…day 2 of her overseas trip to Australia, where she was visiting me during my time working for Blackbaud Pacific.

If you can identify with this scenario, chances are many of the constituents in your Blackbaud CRM database can as well. And for those with an ongoing pledge, recurring gift or membership commitment, an update to your organization is just one of the many update to-dos on their list. And because there are likely no late fees for their donation (unlike those pesky utility bills), chances are they just might forget, leaving you to chase them down. Or worse yet, they may decide upon contact to cancel their commitment. Wouldn’t it be better if there was a service to pro-actively update the card information, saving both time and hassle for the donor and your organization?

Here at Blackbaud, we see the obvious value in these services for you as well…and are thrilled to introduce the Credit Card Updater Service in Blackbaud CRM. The service is now available in Version 4.0 Service Pack 6 and provided by Blackbaud Merchant Services™ (BBMS), so you’ll need to be a BBMS customer. If that’s you, and this has perked your interest…read on for an overview of how it all works. If you’re not yet a BBMS customer but wish to learn more about BBMS or CCU, contact bbms@blackbaud.com.

Getting Set-up:

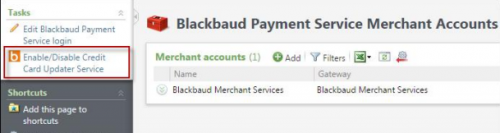

First, contact your BBMS account representative, who will provide you the necessary paperwork for the security and registration processes. Once your enrollment in the service is complete, you must enable Credit Card Updater (CCU) in your production environment. From the Blackbaud Payment Service Merchant Accounts page in Revenue, click Enable/Disable Credit Card Updater Service under Tasks.

Note: As the service updates live card data, it should only be enabled in your Production environment. Likewise, a check to disable in any non-production environments should be added to your post-refresh task list when refreshing a non-production environment.

Receiving Updates:

Once you’ve enrolled in the Service and enabled it in your Production environment, a business process will be automatically created to register and deregister cards in CRM. This process is what ensures the CCU Service is provided the correct cards to update. Cards that will be registered (and hence eligible for updates through the Service) are those cards on file for at least one active, multi-installment revenue commitment paid automatically by a credit card. Specifically:

- Recurring gifts with Active, Held, or Lapsed statuses (…yes, that includes Sponsorship Recurring Gifts!)

- Pledges paid in installments with a non-zero balance

- Membership installment plans with a non-zero balance

- A credit card is manually updated with completely new card information

- A recurring gift status changes to Terminated or Canceled

- A pledge balance changes to zero

- A membership installment plan balance changes to zero

Once available, those updates are retrieved from BBMS (via the business process), and credit card information is updated in CRM. So in sum, a business process runs nightly to register/deregister the correct cards…and one night of the month it will also return the actual updates. To ensure you know when the monthly updates have occurred, set up an email notifications in the BBMS web portal by clicking My User Settings, Email Notifications.

Reviewing Updates

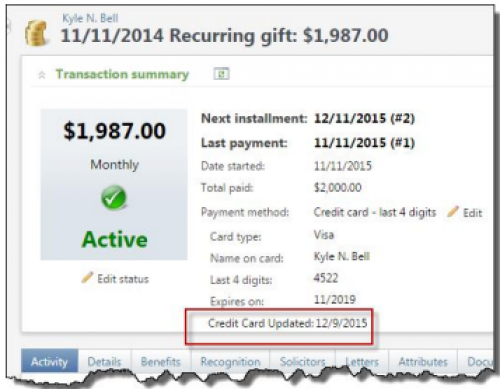

Updates can be tracked via a new query view as well as on the revenue records themselves. When updated by the CCU service, the record will display a “Credit Card Updated” field by the card information as a visual indicator to anyone reviewing the record that the commitment was updated by the service. Note, this field will not be visible if no update has been provided by the Service, or if an update from CCU has since been replaced with a manual update of the card details.

For reviewing your updates in bulk, we recommend creating a query with the new “Credit Card Updates” query view. You can use the status field to review cards either updated or not updated by the service, alongside other constituent and revenue details of your choice, such as previous card information, revenue IDs, etc. With the query view, you can then go on to create a data list, report, smart query, or export to your outside program of choice via the OData link.

In closing

We’re really excited about this feature, and the potential it brings to save you time and money! For more information, be sure to see the CRM 4.0 New Features Guide. The Service Pack New Features chapter of the guide contains information about this feature and others released in Service Pack 6. And for all you BBMS customers, contact your account rep today to start seeing the time and cost savings of fewer expiry letters, fewer declines and rejection letters, and less manual updates immediately!

Leave a Comment

Ivana