What’s Happening With Gift Aid in 2013 - Update

Published

On April 22, 2013, HMRC launches a new system for Gift Aid submission that allows you to send your Gift Aid claims directly from The Raiser’s Edge. This blog post gives you the information you need to know for this change so that you've plenty of time to change over before the paper forms are no longer accepted in October.

WHO NEEDS TO READ THIS BLOG?

Currently, it’s really common that the paper R68 report is created by a Raiser’s Edge user and then passed onto another team to physically send to the HMRC – either on paper or a CD. That user instead will use The Raiser’s Edge to transmit the claim to HMRC – much like what now happens for VAT and PAYE. Do share this blog with them.

The current R68 process will be maintained until the end of September and you have until then to migrate to the new process.

WHAT’S HAPPENING?

Gift Aid is the UK Government scheme to assist charities in claiming back the element that would have been paid in tax for a donation by a UK tax payer. It’s administered by HM Revenue & Customs (HMRC).

Late last year, HMRC announced to many organisations some changes that they have been formulating for some time. This article summarises these changes and lets Blackbaud customers know how we’re changing The Raiser’s Edge to accommodate.

The two changes are:

Gift Aid Small Donations Scheme

The aim of this scheme is to reduce the admin related to very small Gift Aid gifts. The scheme was passed into law in December 2012 and some announcements are planned for 2013 around how it will be implemented along with some previously submitted.

Aside from the software impact, we are aware that various consultations are taking place on how practically viable this scheme is for the level of income that it generates. Therefore, Blackbaud is awaiting the official announcements of the plan and to learn more about how you plan to implement this scheme before we plan any changes. I’ll let you know when we know more!

Charities Online

The Gift Aid process is changing in April 2013 to make it easier to send claims accurately and securely to HMRC. HMRC has launched three formats to replace the R68i form, which is currently used by charities to reclaim the basic income tax portion of a donor's gift. This is part of the government's Digital by Default strategy. The three formats are:

1) Claim Using External Software - HMRC wants customers to move to having their R68i transmitted directly to HMRC from authorised fundraising software. This is quite exciting for us, as it allows a Gift Aid claim to be directly transmitted from The Raiser’s Edge.

2) Claim Using a Paper Form - For charities with very few donations, a manual process will be created to allow a small amount of Gift Aid donations (90 in fact) to be claimed on a paper form.

3) Claim Online - Following an initial consultation last year, a spreadsheet process has been created that will allow up to 1,000 donations to be claimed via an Excel output. The Raiser’s Edge, Blackbaud CRM, and eTapestry are set-up to allow this today so we have this process in hand.

You can read a lot more at HRM Revenue & Customs.

This is a really exciting change that ultimately will make the R68 submitting easier for you. Of course, the Paper Form process will technically work for everyone, so here’s what Blackbaud is planning to do for Raiser’s Edge users:

Claim Online - If you aren’t able to upgrade The Raiser’s Edge, or don’t have many donations per year, then you’ll be able to use Query in The Raiser’s Edge to create the spreadsheet required for the Claim Online process. The Gift Aid schedule spreadsheet is available in Excel format with a limit of only 1000 donations per spreadsheet. We’ll publish some “how-to” steps in Knowledgebase once the new scheme is live.

Claim Using External Software - Early in May 2013, we will release a patch for The Raiser’s Edge version 7.92 that will include a direct connection to HMRC in The Raiser’s Edge Admin function. This will allow you to run your R68 process as you currently do and The Raiser’s Edge will then collate claims by Tax Claim Number in an area ready to be sent to HMRC. Using a login you’ll get from HMRC, you’ll be able to do the following over a secure connection:

We’ll keep a record of your submitted claims in The Raiser’s Edge for future reference.

Basically, this will make Gift Aid claiming easier!

Details on how to get your HMRC login are released later this month and we’ll share them with you once we’ve released this update.

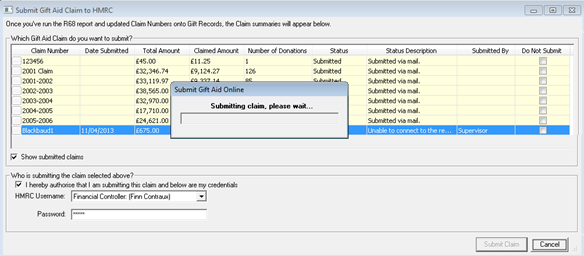

Here’s a little preview of the new submission screen in action:

WHAT SHOULD YOU DO NEXT?

This is a change for many organisations that we’re excited to be making and we’re eager to ensure the process for you is as smooth as possible. The two main things you can do to help prepare are:

I’ll be blogging again in coming months as we go live. Contact your account manager if you have questions in the meantime.

WHO NEEDS TO READ THIS BLOG?

Currently, it’s really common that the paper R68 report is created by a Raiser’s Edge user and then passed onto another team to physically send to the HMRC – either on paper or a CD. That user instead will use The Raiser’s Edge to transmit the claim to HMRC – much like what now happens for VAT and PAYE. Do share this blog with them.

The current R68 process will be maintained until the end of September and you have until then to migrate to the new process.

WHAT’S HAPPENING?

Gift Aid is the UK Government scheme to assist charities in claiming back the element that would have been paid in tax for a donation by a UK tax payer. It’s administered by HM Revenue & Customs (HMRC).

Late last year, HMRC announced to many organisations some changes that they have been formulating for some time. This article summarises these changes and lets Blackbaud customers know how we’re changing The Raiser’s Edge to accommodate.

The two changes are:

- The Gift Aid Small Donations Scheme, allowing small donations to get a top-up gift from the government without having to record a Gift Aid declaration.

- Direct submitting of Gift Aid claims, removing the need for an R68 form. This is known as Charities Online.

Gift Aid Small Donations Scheme

The aim of this scheme is to reduce the admin related to very small Gift Aid gifts. The scheme was passed into law in December 2012 and some announcements are planned for 2013 around how it will be implemented along with some previously submitted.

Aside from the software impact, we are aware that various consultations are taking place on how practically viable this scheme is for the level of income that it generates. Therefore, Blackbaud is awaiting the official announcements of the plan and to learn more about how you plan to implement this scheme before we plan any changes. I’ll let you know when we know more!

Charities Online

The Gift Aid process is changing in April 2013 to make it easier to send claims accurately and securely to HMRC. HMRC has launched three formats to replace the R68i form, which is currently used by charities to reclaim the basic income tax portion of a donor's gift. This is part of the government's Digital by Default strategy. The three formats are:

1) Claim Using External Software - HMRC wants customers to move to having their R68i transmitted directly to HMRC from authorised fundraising software. This is quite exciting for us, as it allows a Gift Aid claim to be directly transmitted from The Raiser’s Edge.

2) Claim Using a Paper Form - For charities with very few donations, a manual process will be created to allow a small amount of Gift Aid donations (90 in fact) to be claimed on a paper form.

3) Claim Online - Following an initial consultation last year, a spreadsheet process has been created that will allow up to 1,000 donations to be claimed via an Excel output. The Raiser’s Edge, Blackbaud CRM, and eTapestry are set-up to allow this today so we have this process in hand.

You can read a lot more at HRM Revenue & Customs.

This is a really exciting change that ultimately will make the R68 submitting easier for you. Of course, the Paper Form process will technically work for everyone, so here’s what Blackbaud is planning to do for Raiser’s Edge users:

Claim Online - If you aren’t able to upgrade The Raiser’s Edge, or don’t have many donations per year, then you’ll be able to use Query in The Raiser’s Edge to create the spreadsheet required for the Claim Online process. The Gift Aid schedule spreadsheet is available in Excel format with a limit of only 1000 donations per spreadsheet. We’ll publish some “how-to” steps in Knowledgebase once the new scheme is live.

Claim Using External Software - Early in May 2013, we will release a patch for The Raiser’s Edge version 7.92 that will include a direct connection to HMRC in The Raiser’s Edge Admin function. This will allow you to run your R68 process as you currently do and The Raiser’s Edge will then collate claims by Tax Claim Number in an area ready to be sent to HMRC. Using a login you’ll get from HMRC, you’ll be able to do the following over a secure connection:

- Send gift aid claims

- Mark a claim as “sponsorship” where donations are recorded to an event participant’s record rather than against donor records

- Get an error message if the file isn’t received for whatever reason, and re-submit (like an online version of Royal Mail Special Delivery)

- Ensure that only approved staff are able to submit claims to HMRC

- Submit multiple years in one claim

We’ll keep a record of your submitted claims in The Raiser’s Edge for future reference.

Basically, this will make Gift Aid claiming easier!

Details on how to get your HMRC login are released later this month and we’ll share them with you once we’ve released this update.

Here’s a little preview of the new submission screen in action:

WHAT SHOULD YOU DO NEXT?

This is a change for many organisations that we’re excited to be making and we’re eager to ensure the process for you is as smooth as possible. The two main things you can do to help prepare are:

- Upgrade to The Raiser’s Edge 7.92, if you haven’t done so already. Keep an eye out for The Raiser’s Edge 7.92 patch, due late April or early May, and plan to install the patch by the end of September.

- If they aren’t the same person, make sure whoever currently runs your R68 report and whoever sends it HMRC are aware of this change.

I’ll be blogging again in coming months as we go live. Contact your account manager if you have questions in the meantime.

News

Blackbaud CRM™ and Blackbaud Internet Solutions™ Blog

04/18/2013 9:45am EDT

Leave a Comment