Double Your Raiser's Edge Donations without Doubling Your Donor Base

Published

How is this possible? It’s easy. Have you ever considered that many of the companies that your donors work for will match donations made to nonprofit organizations? By encouraging your donors to seek out information about their employer’s matching gift policy or doing a little research on your own to find out where your donors (especially the recurring or major donors) work and if their companies have matching gift policies. I know that you’re probably already running thin on time and resources but with just a bit of extra effort, matching gifts can have a big payoff (literally).

When you do discover that an organization has a matching gift program you will definitely want to capture that information so you can properly file the matching gift claim and collect the money. Let’s walk through the best way to store that information in your Raiser’s Edge database.

When you do discover that an organization has a matching gift program you will definitely want to capture that information so you can properly file the matching gift claim and collect the money. Let’s walk through the best way to store that information in your Raiser’s Edge database.

As always, you will first want to search your database to see if the Matching Gift Organization already exists. If they are already a constituent, then rest is a piece of cake. However, if they are not a constituent, you will need to create a constituent record for them so when they match a gift from an individual, they’ll already have a constituent record to link the gift.

Matching Gift Organization Constituent Record

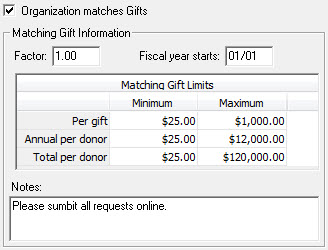

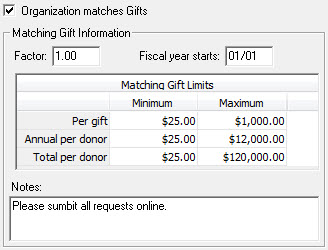

Let’s first discuss how you would enter matching gift information if an organization that matches gifts is already a full constituent or you create a full constituent record for the organization. After you’ve searched for the record, open or create the organization, and click on the Org 1 tab, if you aren’t already there. The Matching Gift information takes up most of the real estate on the right half of the record. The first checkbox acknowledges that this organization does match gifts. This is important to check so you can use it to easily query a group matching gift orgs in the future.

Next, you will need to enter the matching gift factor. This is essentially the ratio that the matching gift organization will match per dollar that the donor is giving. For example, if the organization will match dollar for dollar, enter “1” in the factor field. If the organization will match $.50 for every dollar that their employee donates, you will want to enter .50 into the factor field. You get the point. Keep in mind that the $ is not needed in this field.

The “Fiscal year starts” field allows you to note when the matching gift company’s fiscal year begins. This field becomes tremendously important when approaching this date. Depending on how often you apply for the matching gift funds from the organization (and this sometimes depends on the policy of the matching gift company), you will definitely want to make sure that you’ve applied for the match prior to the date in this field. Once a company ends its fiscal year and close their books, they are often less likely to pay out on a matching gift. There is no need to enter a year in this field since it will be the same date every year so just include a month and day.

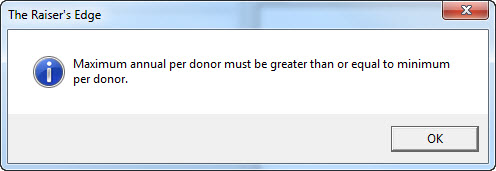

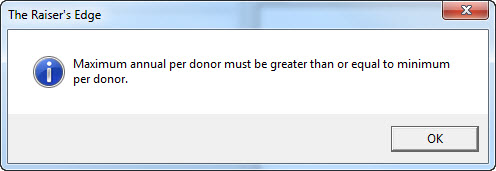

The next table has six fields to define the Matching Gift Limits that the Matching Gift Company defines in their policy. Each organization has different standards so you will want to make sure to read through and capture this information correctly. The first row determines the minimum and maximum per gift limits, the second row determines the limits per donor per year, and the third row captures the minimum and maximum total lifetime amount per donor that the organization will match. The maximum per row must be greater than or equal to the minimum value in the same row and will pop up a warning message if your minimum exceeds your maximum in any row. However, it will not give you a warning message if the “Per gift” maximum or the “Total per donor” maximum is higher than the other maximum fields.

The maximum per row must be greater than or equal to the minimum value in the same row and will pop up a warning message if your minimum exceeds your maximum in any row. However, it will not give you a warning message if the “Per gift” maximum or the “Total per donor” maximum is higher than the other maximum fields.

Finally, the Notes field is a location to store notes that relate specifically to the Matching Gift Limits. This is NOT a field to add general constituent notes; those notes go on the Notes tab. The Matching Gift Notes field is a great place to mention anything else that is important to know about the organizations policy like entering the matching gift application online and the accompanying URL or that you must include a copy of the check that their employee donated to your organization or where to access the matching gift request form.

Setting Up Automatic Matching Gift Pledges

After entering in all pertinent information on the Org 1 tab (based on your organization's policies and procedures), you will want to setup a relationship between the matching gift organization and the individual whose gift will be matched. Go to the Relationship tab and click the button in the upper left hand corner to add a New Individual Relationship. In the Last Name Field, click the binoculars and search for the Individual. Since the individual has most likely already given a gift (which is how you know that the organization matches their gift), they should already have a full constituent record. When you select the record, any information that exists on the individual’s record will copy into the Biographical and Address fields on the relationship record. You will want to fill in the additional information in the bottom sections of the record. Once you complete all of the fields and and check all the appropriate checkboxes on the Relationship record, click Save and close.

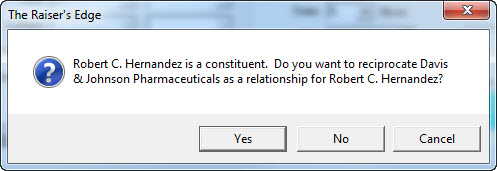

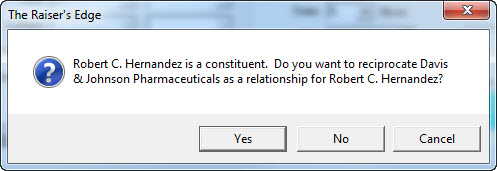

Upon clicking “Save and Close” you will be prompted to reciprocate the organization record with the individual record. If you click “Yes”, it will add the relationship to the relationship tab of the individual’s record. As almost all relationships are two-sided, I strongly suggest clicking “Yes” when prompted. You will then want to save and close the Organization Constituent record for the Matching Gift Organization.

Upon clicking “Save and Close” you will be prompted to reciprocate the organization record with the individual record. If you click “Yes”, it will add the relationship to the relationship tab of the individual’s record. As almost all relationships are two-sided, I strongly suggest clicking “Yes” when prompted. You will then want to save and close the Organization Constituent record for the Matching Gift Organization.

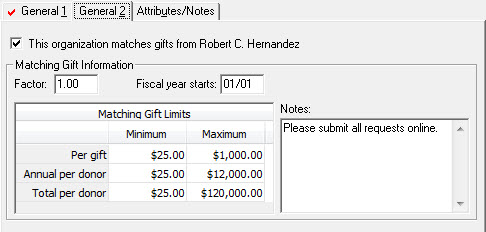

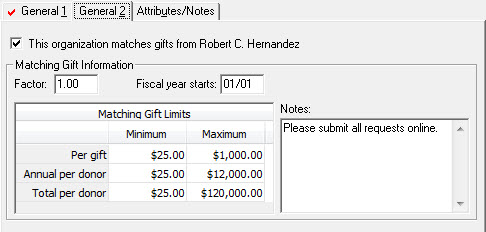

Open the Individual’s constituent record and navigate to the Relationships tab. Open the Organization Relationship record that you just saved and closed. Click on the General 2 tab. If the checkbox on the Org 1 tab (“This Organization Matches Gifts”) is checked, the first checkbox “This organization matches gifts from ___________ (Individual’s name)” on the General 2 tab of the individual relationship should already have defaulted as checked. Just double check that it is checked. This option is great for helping you remember to submit the matching gift request.

The Matching Gift Information should have already copied from the Org 1 tab of the Matching Gift Organization’s Org 1 tab. However, if it did not, you will need to enter all the same information including the “Matching Gift Factor“, the “Fiscal year stats” date and the minimum and maximum “Matching Gift Limits”. It is important to note that anything entered on this tab is unique to the individual’s relationship with the organization and is no longer connected to the information on the Org 1 tab. Therefore if any information that changes with the Organization’s matching gift policy would need to change on the General 2 tab of the relationship record. Additionally, if the individual has a special relationship with the organization and has a different match factor or match limits, this information will have to be updated on this tab as well. When you’re finished with that, click “Save and Close”.

It is important to remember to complete any other tasks that your organization might require as it relates to matching gifts in The Raiser’s Edge. For example, some organizations require users to include a constituent code for matching gift organizations (only available for constituent records) or make a note on the Notes or Actions tab that you entered this information into the record.

One last thing, don’t forget to look up a list of matching gift companies. A quick Google search can provide a very good list of major organizations that have matching gift policies. When I entered "matching gift companies" into Google, the first result I found was a nice list provided by a site called Double the Donation.

I hope that you found this week’s entry helpful. If you did, please let me know if the comments below. If you didn't please let me know what I could add or change to make it better. Additionally, here are the next few topics that I’m planning on writing about. Vote for your favorite topic and I’ll write about it next week. Also, feel free to let me know any ideas that you have for future articles that you’d want me to write about.

Potential Future Topics:

Until next time…

When you do discover that an organization has a matching gift program you will definitely want to capture that information so you can properly file the matching gift claim and collect the money. Let’s walk through the best way to store that information in your Raiser’s Edge database.

When you do discover that an organization has a matching gift program you will definitely want to capture that information so you can properly file the matching gift claim and collect the money. Let’s walk through the best way to store that information in your Raiser’s Edge database.As always, you will first want to search your database to see if the Matching Gift Organization already exists. If they are already a constituent, then rest is a piece of cake. However, if they are not a constituent, you will need to create a constituent record for them so when they match a gift from an individual, they’ll already have a constituent record to link the gift.

Matching Gift Organization Constituent Record

Let’s first discuss how you would enter matching gift information if an organization that matches gifts is already a full constituent or you create a full constituent record for the organization. After you’ve searched for the record, open or create the organization, and click on the Org 1 tab, if you aren’t already there. The Matching Gift information takes up most of the real estate on the right half of the record. The first checkbox acknowledges that this organization does match gifts. This is important to check so you can use it to easily query a group matching gift orgs in the future.

Next, you will need to enter the matching gift factor. This is essentially the ratio that the matching gift organization will match per dollar that the donor is giving. For example, if the organization will match dollar for dollar, enter “1” in the factor field. If the organization will match $.50 for every dollar that their employee donates, you will want to enter .50 into the factor field. You get the point. Keep in mind that the $ is not needed in this field.

The “Fiscal year starts” field allows you to note when the matching gift company’s fiscal year begins. This field becomes tremendously important when approaching this date. Depending on how often you apply for the matching gift funds from the organization (and this sometimes depends on the policy of the matching gift company), you will definitely want to make sure that you’ve applied for the match prior to the date in this field. Once a company ends its fiscal year and close their books, they are often less likely to pay out on a matching gift. There is no need to enter a year in this field since it will be the same date every year so just include a month and day.

The next table has six fields to define the Matching Gift Limits that the Matching Gift Company defines in their policy. Each organization has different standards so you will want to make sure to read through and capture this information correctly. The first row determines the minimum and maximum per gift limits, the second row determines the limits per donor per year, and the third row captures the minimum and maximum total lifetime amount per donor that the organization will match.

The maximum per row must be greater than or equal to the minimum value in the same row and will pop up a warning message if your minimum exceeds your maximum in any row. However, it will not give you a warning message if the “Per gift” maximum or the “Total per donor” maximum is higher than the other maximum fields.

The maximum per row must be greater than or equal to the minimum value in the same row and will pop up a warning message if your minimum exceeds your maximum in any row. However, it will not give you a warning message if the “Per gift” maximum or the “Total per donor” maximum is higher than the other maximum fields.Finally, the Notes field is a location to store notes that relate specifically to the Matching Gift Limits. This is NOT a field to add general constituent notes; those notes go on the Notes tab. The Matching Gift Notes field is a great place to mention anything else that is important to know about the organizations policy like entering the matching gift application online and the accompanying URL or that you must include a copy of the check that their employee donated to your organization or where to access the matching gift request form.

Setting Up Automatic Matching Gift Pledges

After entering in all pertinent information on the Org 1 tab (based on your organization's policies and procedures), you will want to setup a relationship between the matching gift organization and the individual whose gift will be matched. Go to the Relationship tab and click the button in the upper left hand corner to add a New Individual Relationship. In the Last Name Field, click the binoculars and search for the Individual. Since the individual has most likely already given a gift (which is how you know that the organization matches their gift), they should already have a full constituent record. When you select the record, any information that exists on the individual’s record will copy into the Biographical and Address fields on the relationship record. You will want to fill in the additional information in the bottom sections of the record. Once you complete all of the fields and and check all the appropriate checkboxes on the Relationship record, click Save and close.

Upon clicking “Save and Close” you will be prompted to reciprocate the organization record with the individual record. If you click “Yes”, it will add the relationship to the relationship tab of the individual’s record. As almost all relationships are two-sided, I strongly suggest clicking “Yes” when prompted. You will then want to save and close the Organization Constituent record for the Matching Gift Organization.

Upon clicking “Save and Close” you will be prompted to reciprocate the organization record with the individual record. If you click “Yes”, it will add the relationship to the relationship tab of the individual’s record. As almost all relationships are two-sided, I strongly suggest clicking “Yes” when prompted. You will then want to save and close the Organization Constituent record for the Matching Gift Organization.Open the Individual’s constituent record and navigate to the Relationships tab. Open the Organization Relationship record that you just saved and closed. Click on the General 2 tab. If the checkbox on the Org 1 tab (“This Organization Matches Gifts”) is checked, the first checkbox “This organization matches gifts from ___________ (Individual’s name)” on the General 2 tab of the individual relationship should already have defaulted as checked. Just double check that it is checked. This option is great for helping you remember to submit the matching gift request.

The Matching Gift Information should have already copied from the Org 1 tab of the Matching Gift Organization’s Org 1 tab. However, if it did not, you will need to enter all the same information including the “Matching Gift Factor“, the “Fiscal year stats” date and the minimum and maximum “Matching Gift Limits”. It is important to note that anything entered on this tab is unique to the individual’s relationship with the organization and is no longer connected to the information on the Org 1 tab. Therefore if any information that changes with the Organization’s matching gift policy would need to change on the General 2 tab of the relationship record. Additionally, if the individual has a special relationship with the organization and has a different match factor or match limits, this information will have to be updated on this tab as well. When you’re finished with that, click “Save and Close”.

It is important to remember to complete any other tasks that your organization might require as it relates to matching gifts in The Raiser’s Edge. For example, some organizations require users to include a constituent code for matching gift organizations (only available for constituent records) or make a note on the Notes or Actions tab that you entered this information into the record.

One last thing, don’t forget to look up a list of matching gift companies. A quick Google search can provide a very good list of major organizations that have matching gift policies. When I entered "matching gift companies" into Google, the first result I found was a nice list provided by a site called Double the Donation.

I hope that you found this week’s entry helpful. If you did, please let me know if the comments below. If you didn't please let me know what I could add or change to make it better. Additionally, here are the next few topics that I’m planning on writing about. Vote for your favorite topic and I’ll write about it next week. Also, feel free to let me know any ideas that you have for future articles that you’d want me to write about.

Potential Future Topics:

- The Relationship Tree

- Sharing and Linking Address Records

- Filters on Constituent Record Tabs

- The Value of the Constituent Window in a Constituent Batch

- Query Formats Explained (Static vs. Dynamic)

Until next time…

News

Raiser's Edge® Blog

09/11/2013 6:56am EDT

Leave a Comment