SEPA Direct Debit Coming to The Raiser’s Edge (UK)

Published

In the second half of November 2013, Blackbaud plans to release changes to the UK version of The Raiser’s Edge to support the new European Single Euro Payments Area (SEPA) Direct Debit process. We’ve not offered banking functionality beyond the UK previously, so this is a really exciting change for us. This blog post outlines what the functionality will include, and gives our non-UK European customers some guidance on what to expect for the upgrade and the migration to SEPA in the run-up to the 1st February 2014 deadline. There will be a more detailed guide at release, but we want to be sure you’re aware of the key steps so you can start to prepare.

Upgrades

The SEPA functionality will be released as a version 7.93 patch. So, you’ll need to upgrade to 7.93 (released at the end of this month) and the SEPA patch when it is released in late November. You won’t have to switch to SEPA straight after upgrade – this will just give you the option.

SEPA Set-Up

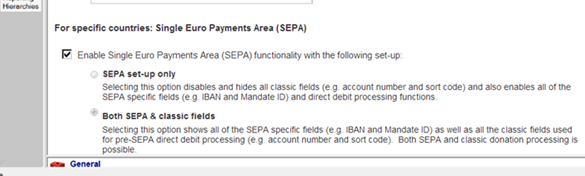

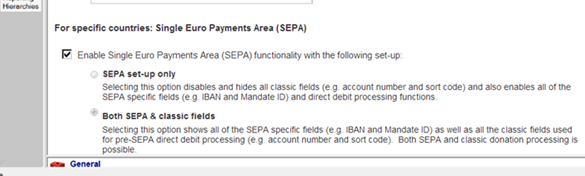

Once you’ve upgraded, you’ll be given the option to switch on the SEPA features.

We expect current Raiser’s Edge customers will want to choose “Both SEPA & classic fields” so that you can see your current bank account numbers. This option will also allow our customers to keep running their current direct debit EFT processes whilst testing the SEPA file generation process in parallel.

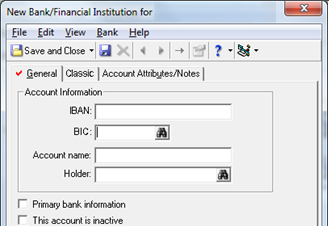

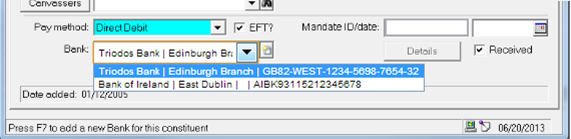

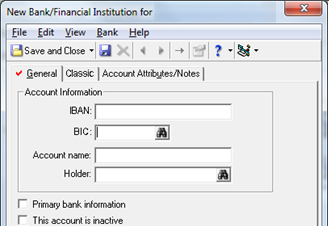

The SEPA fields then become available on financial institution relationship records:

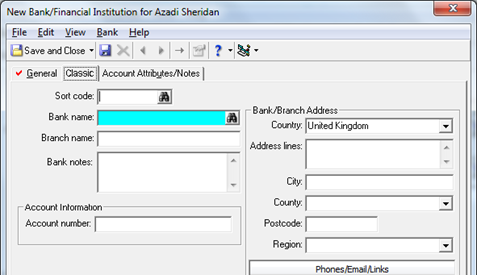

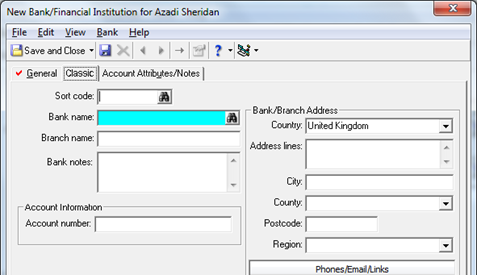

The existing account numbers do not go away and are stored in a “Classic” tab.

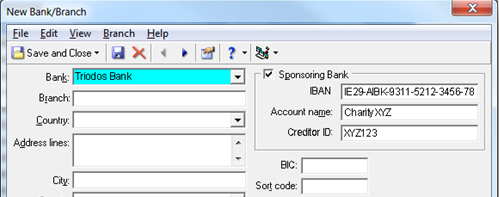

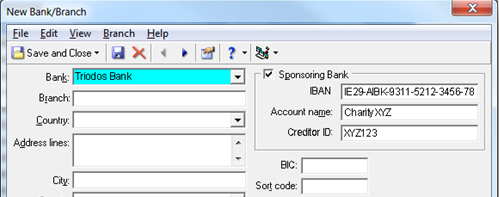

You’ll then need to enter in the required SEPA fields for your paying-in account:

This screen will also include the additional configurations needed to make the file output correct for your bank.

Migrating to IBAN and BIC

The Raiser’s Edge Export and Import will be changed to allow your financial institution relationship records to be updated. You’ll use export to extract donor sort codes (or similar, if you have them), account numbers and an import ID. Using your local banking system’s update website you can get this file updated to include IBANs (and BICs if your country requires them). You’ll then be able to use Import to update the financial institution records with the new IBAN and BIC. The old account numbers are retained so you can keep using them.

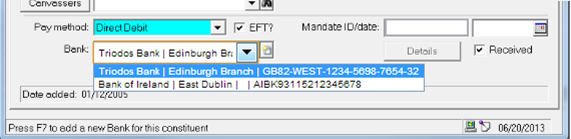

The recurring gift records are linked up, so that they are updated automatically:

The field previously called “reference number” is now the SEPA Mandate ID. We’ll let you enter what you’d like, and will ensure the number is unique.

Generating a SEPA Direct Debit batch

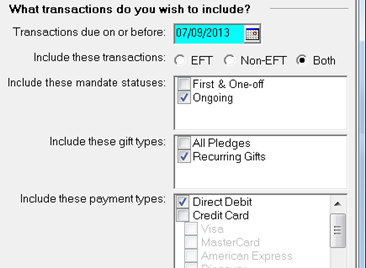

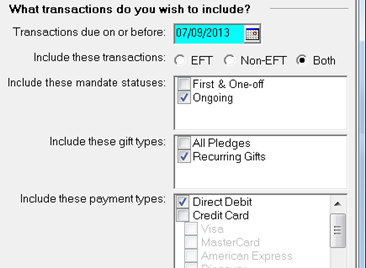

In SEPA Direct Debits, you get the option to decide whether the file includes New and One-Off gifts (also known as D-6 or D-5) or recurring (D-3 or D-2) or indeed both if you / your bank prefer. We’ll then use the Pledge and Recurring Gift data to get the right data into the batch.

Note that there will also be a process to send out Direct Debit confirmations (also note as Pre-Notifications) in the acknowledgement letter process and The Raiser’s Edge won’t let you include gifts that haven’t been sent this confirmation letter.

Exporting the SEPA Direct Debit File

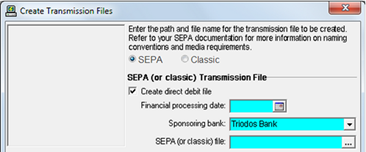

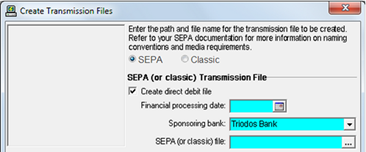

From this point, when you generate a Direct Debit batch, you’ll get two options. You can either keep generating your current file format or you can use the new SEPA format.

We’ll use your sponsoring bank set-up to determine the file format for your bank.

The new direct debit collections file is called the PAIN.008 file. We are planning to release PAIN.008 file formats for the following banks we are aware our customers use. If you process Direct Debits with other banks, please let Blackbaud Support know as soon as possible and we’ll be happy to review that.

What next?

If your bank is not on the list above, please let us know as soon as you can!

Nearer the time of the release, we’ll update you with our consultancy packages where we can help you through this migration.

Note that this document shows the screen designs, and is subject to minor changes in the final release.

If you have any further questions – please contact Blackbaud Support support@blackbaud.co.uk

Upgrades

The SEPA functionality will be released as a version 7.93 patch. So, you’ll need to upgrade to 7.93 (released at the end of this month) and the SEPA patch when it is released in late November. You won’t have to switch to SEPA straight after upgrade – this will just give you the option.

SEPA Set-Up

Once you’ve upgraded, you’ll be given the option to switch on the SEPA features.

We expect current Raiser’s Edge customers will want to choose “Both SEPA & classic fields” so that you can see your current bank account numbers. This option will also allow our customers to keep running their current direct debit EFT processes whilst testing the SEPA file generation process in parallel.

The SEPA fields then become available on financial institution relationship records:

The existing account numbers do not go away and are stored in a “Classic” tab.

You’ll then need to enter in the required SEPA fields for your paying-in account:

This screen will also include the additional configurations needed to make the file output correct for your bank.

Migrating to IBAN and BIC

The Raiser’s Edge Export and Import will be changed to allow your financial institution relationship records to be updated. You’ll use export to extract donor sort codes (or similar, if you have them), account numbers and an import ID. Using your local banking system’s update website you can get this file updated to include IBANs (and BICs if your country requires them). You’ll then be able to use Import to update the financial institution records with the new IBAN and BIC. The old account numbers are retained so you can keep using them.

The recurring gift records are linked up, so that they are updated automatically:

The field previously called “reference number” is now the SEPA Mandate ID. We’ll let you enter what you’d like, and will ensure the number is unique.

Generating a SEPA Direct Debit batch

In SEPA Direct Debits, you get the option to decide whether the file includes New and One-Off gifts (also known as D-6 or D-5) or recurring (D-3 or D-2) or indeed both if you / your bank prefer. We’ll then use the Pledge and Recurring Gift data to get the right data into the batch.

Note that there will also be a process to send out Direct Debit confirmations (also note as Pre-Notifications) in the acknowledgement letter process and The Raiser’s Edge won’t let you include gifts that haven’t been sent this confirmation letter.

Exporting the SEPA Direct Debit File

From this point, when you generate a Direct Debit batch, you’ll get two options. You can either keep generating your current file format or you can use the new SEPA format.

We’ll use your sponsoring bank set-up to determine the file format for your bank.

The new direct debit collections file is called the PAIN.008 file. We are planning to release PAIN.008 file formats for the following banks we are aware our customers use. If you process Direct Debits with other banks, please let Blackbaud Support know as soon as possible and we’ll be happy to review that.

- Ireland – Bank of Ireland, AIB

- Netherlands – ING, ABN Amro

- Belgium - ING

- Germany - Bank für Sozialwirtschaft Berlin, PostBank

What next?

If your bank is not on the list above, please let us know as soon as you can!

Nearer the time of the release, we’ll update you with our consultancy packages where we can help you through this migration.

Note that this document shows the screen designs, and is subject to minor changes in the final release.

If you have any further questions – please contact Blackbaud Support support@blackbaud.co.uk

News

Raiser's Edge® Blog

09/24/2013 6:57am EDT

Leave a Comment