4.1 New Features: Taxes on Merchandise

Published

Exciting changes are on the way for how we apply taxes to merchandise in Altru. We've made is much easier to not only configure new taxes but manage existing taxes for merchandise. You can now apply different types of taxes to merchandise items in the same department. This means that merchandise taxes are no longer dependent on the department the item is in.

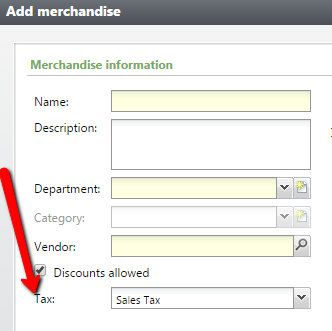

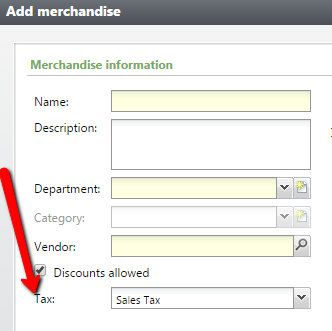

For example, when you configure a department you no longer have to specify whether it is taxable. On the merchandise item, you will select which tax applies to the specific item (or no tax at all). This gives you the flexibility to apply tax on an item by item basis instead of across the board.

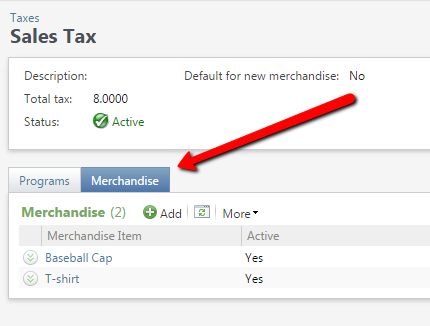

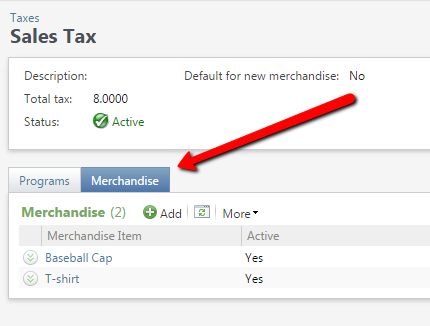

You can also apply taxes to merchandise items directly on the tax record. The new merchandise tax on the tax record displays all merchandise items the tax applies to. You can add other items directly to the tax.

Check out this video about how you can configure and implement the new tax features in Altru. For more information about merchandise taxes and other features in the 4.1 release, check out the release page.

For example, when you configure a department you no longer have to specify whether it is taxable. On the merchandise item, you will select which tax applies to the specific item (or no tax at all). This gives you the flexibility to apply tax on an item by item basis instead of across the board.

You can also apply taxes to merchandise items directly on the tax record. The new merchandise tax on the tax record displays all merchandise items the tax applies to. You can add other items directly to the tax.

Check out this video about how you can configure and implement the new tax features in Altru. For more information about merchandise taxes and other features in the 4.1 release, check out the release page.

News

ARCHIVED | Blackbaud Altru® Tips and Tricks

02/04/2015 9:29am EST

Leave a Comment