Receiving and Selling Gifts of Stock in Altru

Published

Ever wondered how stock gifts really work in Altru? It’s easier than you thought! Sit back and let Altru do all the work for you.

If you receive stock as a donation to your organization, you may need to record the information about the stock gift in Altru. It is important to keep a record of this if you are keeping the stock or if you are only selling a portion.

Note: If you are receiving a check from the brokerage firm, enter the gift with a payment method of Check.

To record a gift of stock in Altru follow the steps below:

Once you have stock gifts in Altru, it's time to sell them! From the original payment record, you can sell the stock. Follow these steps:

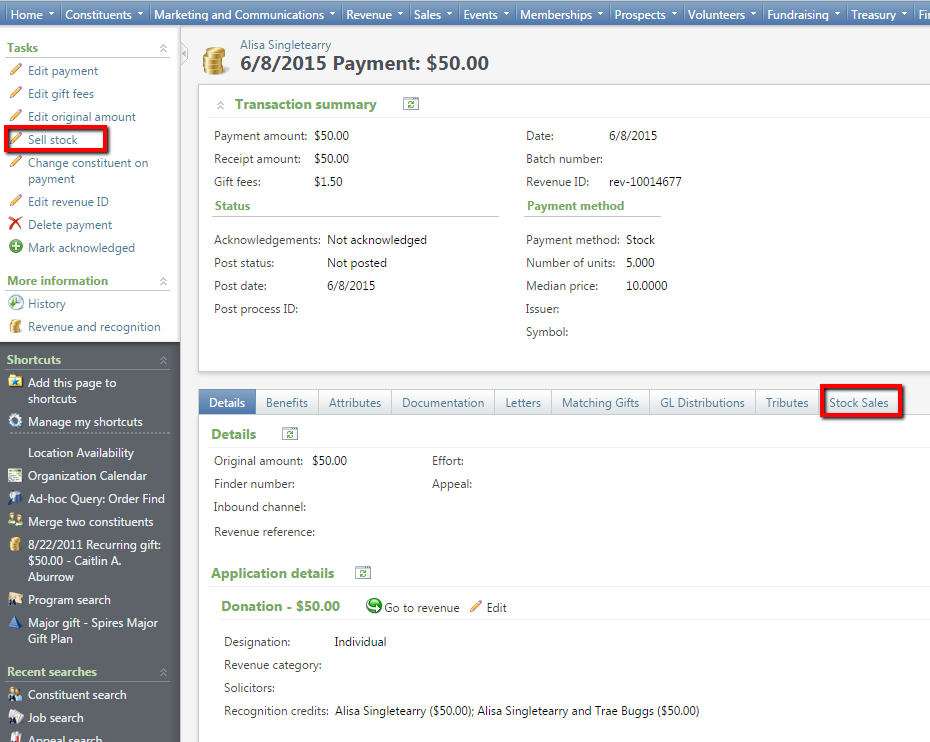

The payment will now have a Stock Sales tab that will allow you to access the sale information related to this payment.

A piece of good news is that you can unsell stock if you need to! On the payment record, you can remove the stock sale and return to the original payment by clicking Unsell stock under Tasks (only after the stock has been sold.)

A piece of good news is that you can unsell stock if you need to! On the payment record, you can remove the stock sale and return to the original payment by clicking Unsell stock under Tasks (only after the stock has been sold.)

Stock gifts record to the General Ledger differently than other payment methods. Be sure to check out this guide on which journal entries are created in the General Ledger when posting stock gifts. It is recommended that you contact your Certified Public Accountant (CPA) for specific recommendations on accounting for these transactions.

Now that you are an expert on selling stock, time to get started!

If you receive stock as a donation to your organization, you may need to record the information about the stock gift in Altru. It is important to keep a record of this if you are keeping the stock or if you are only selling a portion.

Note: If you are receiving a check from the brokerage firm, enter the gift with a payment method of Check.

To record a gift of stock in Altru follow the steps below:

- Go to the constituent record.

- Click Add Payment under Tasks.

- Enter the applicable payment information.

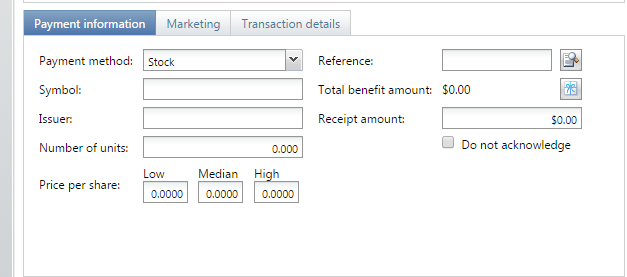

- For the payment method, select Stock.

- Altru requires you to enter the Median Price per share and the Number of units. The median price multiplied by the number of units must equal the amount entered for the payment.

- Enter Issuer, Stock Symbol, the Low Price per share, and the High Price per share, if desired.

- Click Save.

Once you have stock gifts in Altru, it's time to sell them! From the original payment record, you can sell the stock. Follow these steps:

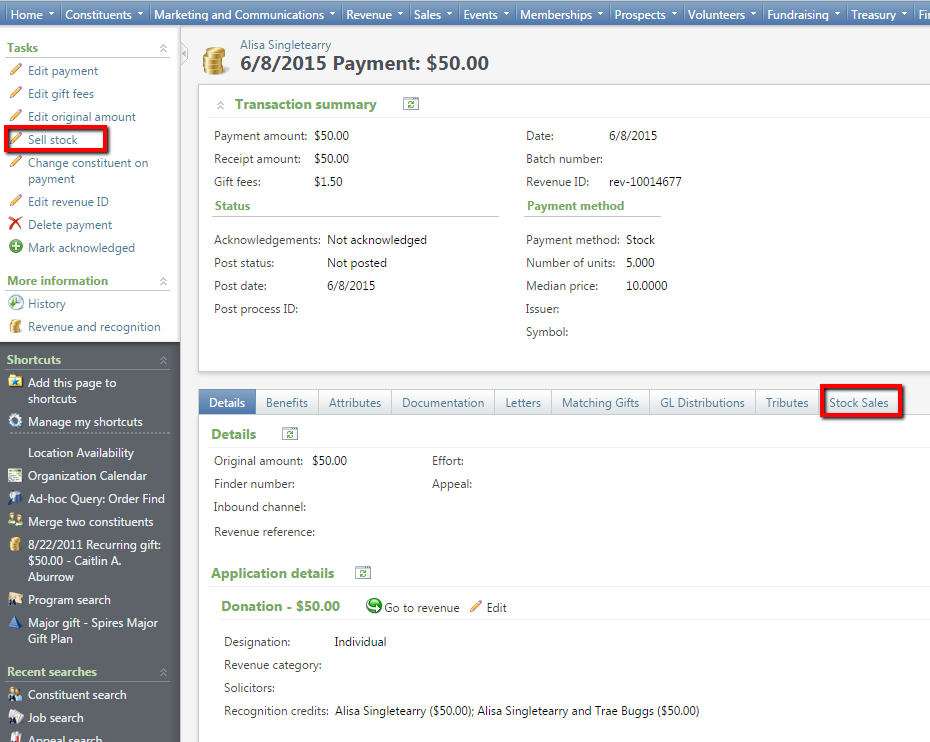

- Under Tasks, click Sell stock.

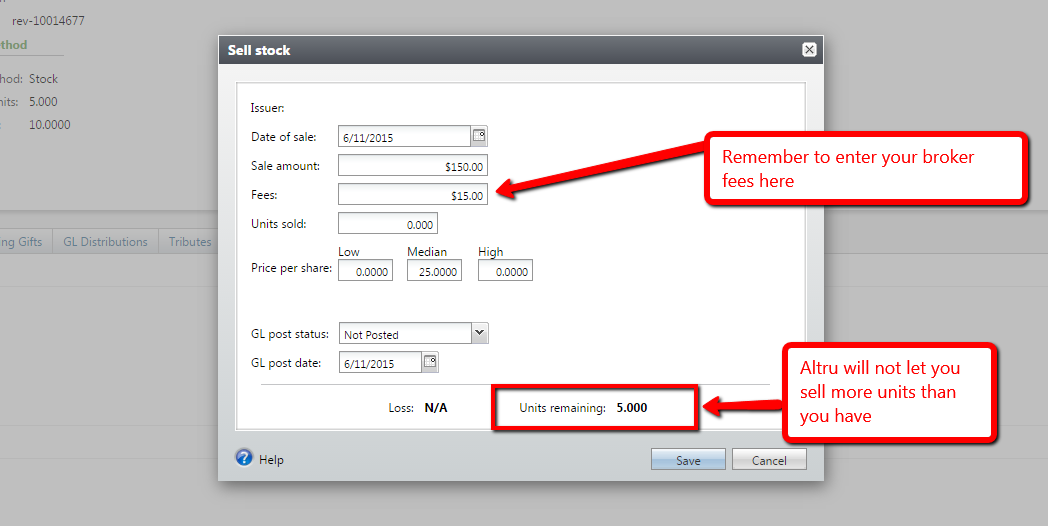

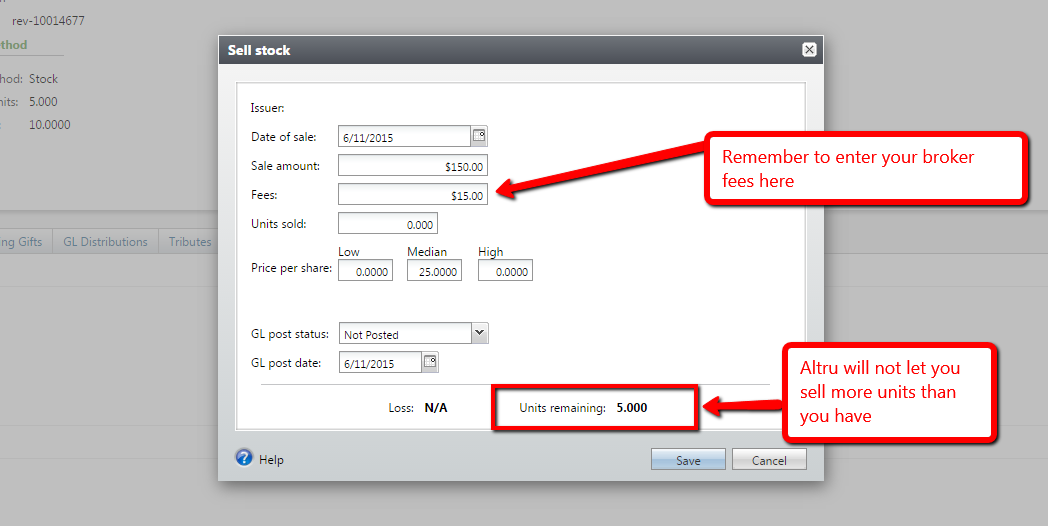

- On the Sell stock screen enter the following details:

- Date of sale

- Sale amount

- Fees

- Units sold

- Median Price per share (Low and High Price per share are not required, but optional). The Median Price per share multiplied by the number of Units sold, must equal the Sale amount entered.

- Enter the GL post status and GL post date if your organization is using the Altru General Ledger.

- Click Save. Altru will record the remaining units and loss or gain.

The payment will now have a Stock Sales tab that will allow you to access the sale information related to this payment.

A piece of good news is that you can unsell stock if you need to! On the payment record, you can remove the stock sale and return to the original payment by clicking Unsell stock under Tasks (only after the stock has been sold.)

A piece of good news is that you can unsell stock if you need to! On the payment record, you can remove the stock sale and return to the original payment by clicking Unsell stock under Tasks (only after the stock has been sold.)Stock gifts record to the General Ledger differently than other payment methods. Be sure to check out this guide on which journal entries are created in the General Ledger when posting stock gifts. It is recommended that you contact your Certified Public Accountant (CPA) for specific recommendations on accounting for these transactions.

Now that you are an expert on selling stock, time to get started!

News

ARCHIVED | Blackbaud Altru® Tips and Tricks

06/18/2015 8:00am EDT

Leave a Comment