Easier Credit Card Reconciliation in 8 Steps!

Published

If you’re anything like me, the beginning of a new year is a time for reflection on how you can simplify your life, organize your home, get healthier, and overall make your life easier. Over the years, I’ve worked with a number of customers who have discrepancies between Blackbaud Merchant Services (BBMS) and Altru at the end of the month. They ask me how to find these discrepancies, and how to find them more quickly, so they can close out their month.

From these conversations, I have created a series of 8 steps I use when reconciling BBMS to Altru after a disbursement, and I’ve written these out below, in the hopes that it speeds up your current reconciliation process!

I hope my 8 steps have simplified your reconciliation process! After all, new year, new you!

From these conversations, I have created a series of 8 steps I use when reconciling BBMS to Altru after a disbursement, and I’ve written these out below, in the hopes that it speeds up your current reconciliation process!

- Run BBMS Disbursement report for each week in the month. You can download your disbursement report directly from BBMS or better yet, stay in one database for reconciling and download it from Altru.

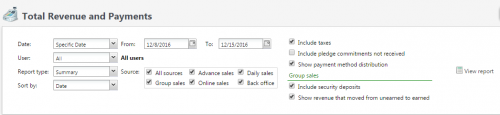

- Run the Total Revenue Report for each of those same periods in the month with the box marked to show payment method distribution. Go to Revenue > Under Reports, select Total Revenue and Payments. Tip: I also recommend marking “Show Taxes,” “Show Security Deposits,” and “Show revenue that moved from unearned to earned.” This way all payments and revenue are included on your report.

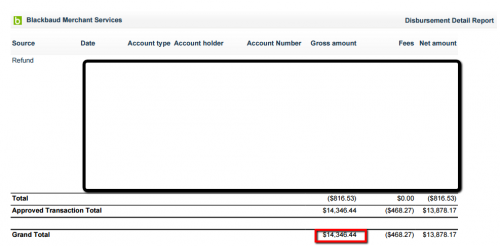

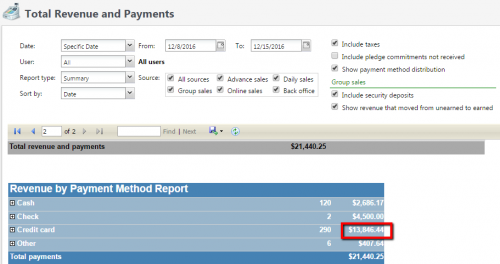

- Compare the BBMS Disbursement Grand Total Gross Amount at the bottom of the report to the Revenue by Payment Method Credit Card Total on the bottom of the Total Revenue Report. If the two numbers match, there is no further reconciliation necessary. If they do not match, note the difference. Do not look at net amounts on the Disbursement Report, as this takes out the BBMS fees and will not match Altru.

- For each of these periods that is off, go to Treasury > reconcile transactions and disbursements. Tip: This feature automatically uploads disbursement reports from BBMS and matches transactions from Altru to the BBMS Disbursement. It then identifies which credit card transactions in Altru are not included in the disbursement or which items are in the disbursement that don’t match a transaction in Altru. This saves you tons of time reconciling line by line and identifies major discrepancies for you! Read more about this feature, how to turn it on, and how to use it. This is a crucial part of my reconciliation time-savings!

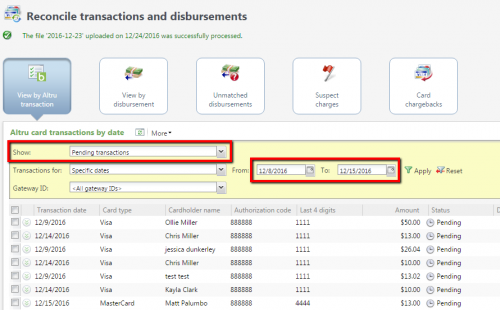

- In Treasury > reconcile transactions and disbursements, go to the View by Altru transaction tab. Filter on Show Pending transactions and Transactions for the specific disbursement dates. Click Apply. This will help you identify pending transactions that are in Altru but not in the BBMS Disbursement. Tip: These could include back office credit card payments where no one marked the box to Authorize card on save so the card was not charged, or payments in a batch that were not run through Credit Card Processing and an authorization code was manually entered.

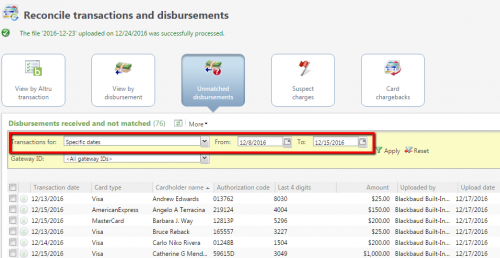

- Next, in Treasury > Reconcile Transactions and Disbursements, go to the Unmatched Disbursements tab. Again, filter on Transactions for the specific dates of your disbursement. On the Unmatched Disbursements tab, look for any transaction that doesn’t wash out. You’ll frequently see one amount then the same negative amount right in a row with the same date—this is a canceled Daily Sales order and washes itself out—but we want to look for a single line that doesn’t have another match on this page that wouldn’t wash out. These are charges or refunds that are in Blackbaud Merchant Services that aren’t in Altru. Tip: This could include transactions entered directly into the BBMS Web Portal or Mobile Pay. This could also include refunds done directly through BBMS. This could include back office Altru credit card payments that were deleted (since there is no longer a record of the payment in Altru). There are steps in our Knowledgebase on doing additional investigation into charges in BBMS that are not in Altru.

- If there is amount off between Altru and BBMS but nothing shows in the Unmatched disbursements tab and your organization is not in Eastern Standard time (EST), look at the very top of your Disbursement report for transactions between 12am-5pm on the first day of your disbursement. Because the Altru database is in not EST but BBMS is in EST, a transaction in Altru at 11pm CST for example, falls in BBMS on 12am EST the next day. If this day happens to be the start of the disbursement period, it could cause Altru and BBMS to be off the amount of the transaction. These transactions do not show in unmatched disbursements as Altru knows that BBMS is in EST and accounts for that. If Altru is more than BBMS, look at the next disbursement report to see if that money is the first transaction on the next report. If BBMS is more than Altru, look at the prior Total Revenue Report to see if that money is in the Total Revenue Report for the last period. Also look at last transaction in that period in case it is in Altru but falls on the next day in BBMS due to being late at night.

- Finally, on the disbursement reports, look for chargebacks. There is a specific page in the Disbursement Report that details any chargebacks in that period. Chargebacks can cause BBMS to be less than Altru because there is a $15 fee associated with them, and Altru does not display chargeback fees in the Altru database. They are only in BBMS.

I hope my 8 steps have simplified your reconciliation process! After all, new year, new you!

News

ARCHIVED | Blackbaud Altru® Tips and Tricks

01/13/2017 1:29pm EST

Leave a Comment