New Feature: Apply Event Registration Fees as a Donation

Published

In the 3.0 release, we've added the ability to credit a portion of an event registration fee towards a donation.

Let’s say your silent auction dinner sells for $75 a ticket. It costs you $45 per person to cover the food, drinks, seating, and entertainment. You will now be able to credit the remainder of the fee as a donation to a specific designation. This means you’ll have $45 going towards Event Registration revenue and $30 as a charitable donation. This will allow you to better report on the money you raised for your organization at the event.

Here’s how you would set this up:

1. When you add your event, check the box for "Event allows designations on fees."

2. On the Event record, go to the Designation tab and select which designation(s) are allowed for this event.

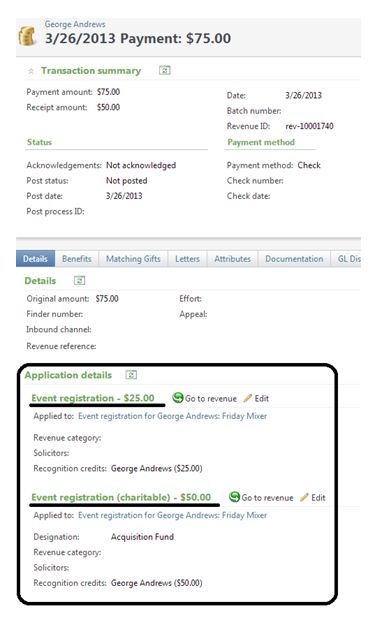

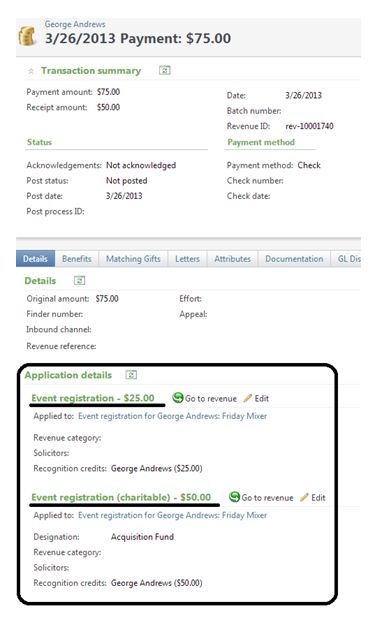

3. As constituents begin to register for the event, you can view the donation on the Details tab, and account distribution on the GL Distribution's tab.

The Event Profile and Event Revenue report will display the donated portion of the event fees as a donation.

One thing to note, you will only be able to refund event registrations that allow designations if they are purchased through daily or advanced sales. If payments are made through the back office (including payments made as part of batches or from revenue records outside of Sales and Treasury), you will not be able refund them.

This new functionality will allow you to easily report on your net profits from fundraising events and ensures your funds are properly allocated!

Let’s say your silent auction dinner sells for $75 a ticket. It costs you $45 per person to cover the food, drinks, seating, and entertainment. You will now be able to credit the remainder of the fee as a donation to a specific designation. This means you’ll have $45 going towards Event Registration revenue and $30 as a charitable donation. This will allow you to better report on the money you raised for your organization at the event.

Here’s how you would set this up:

1. When you add your event, check the box for "Event allows designations on fees."

2. On the Event record, go to the Designation tab and select which designation(s) are allowed for this event.

3. As constituents begin to register for the event, you can view the donation on the Details tab, and account distribution on the GL Distribution's tab.

The Event Profile and Event Revenue report will display the donated portion of the event fees as a donation.

One thing to note, you will only be able to refund event registrations that allow designations if they are purchased through daily or advanced sales. If payments are made through the back office (including payments made as part of batches or from revenue records outside of Sales and Treasury), you will not be able refund them.

This new functionality will allow you to easily report on your net profits from fundraising events and ensures your funds are properly allocated!

News

ARCHIVED | Blackbaud Altru® Tips and Tricks

04/10/2013 8:52am EDT

Leave a Comment