Is Wealth Screening Useful For Planned Giving Programs?

Published

I recently read a series of e-conversations on a popular discussion board related to planned giving. The topical question was “Is Wealth Screening Useful for Planned Giving Programs?” The consensus was that they’ve not been as helpful for planned giving prospecting as we would like them to be.

I’m sitting on both sides of the fence on this one.

- I’m on the “No” side because I agree that the traditional way “wealth screenings” have been used, isn’t the way planned giving professionals should be using them.

- I’m on the “Yes” side because there’s more to a wealth screening than wealth! There’s a lot of information in what’s more appropriately called a “Prospect Screening” or a “Public-Record and Philanthropy Screening” than just wealth information.

Prospecting for Constituents with Known Planned Gifts.

Who’s likely to tell you that they’ve already made a planned gift to your organization? People who are close to completing or who have already completed their estate planning.

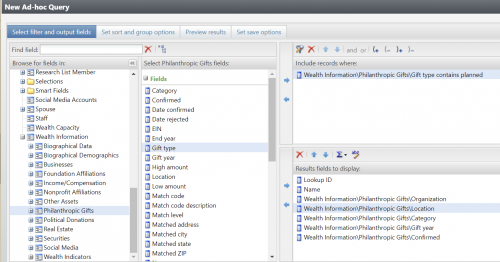

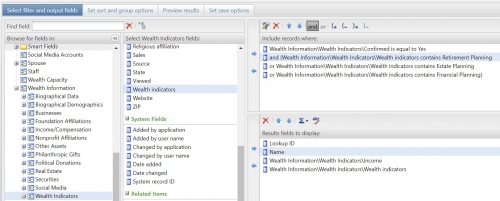

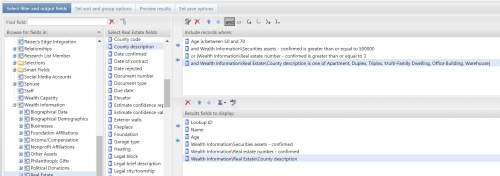

Most prospect screening services also include philanthropic giving history and biographical information too. The Blackbaud Target Analytics® WealthPoint® database returns data from NOZAsearch™, the world’s largest searchable database of charitable donations. NOZA currently contains over 146 million U.S. organization gift transaction records it gathered from 123,369 sources – and it’s adding a million or more records per month. There’s over 9 million gift transaction records from Canadian organizations as well – gathering their data from over 16,000 sources. In both the U.S. and the Canadian records results for known planned gifts are returned. There’s a NOZA Donation Category called Planned & Legacy Gift / Deferred Gift / Bequest / Estate Gift. Bingo! Here’s a great way to find out if your prospect has already made a planned gift to another organization that has publicly recognized him or her for the notification. If you use ResearchPoint™, our prospect research software that accesses the WealthPoint data sources. you're tapping into a searchable database of more than 110 million US households, and 200 million consumers. You can use search results to create a query to isolate a list of constituents with known planned gifts. Otherwise, you can create a query looking for wealth indicator interests in estate planning, retirement and financial planning. Here’s how:

Finding Known Planned Gifts in ResearchPoint

Prospecting for Gift Annuity and I.R.A. Charitable Roll-over Gifts.Who’s most likely to contract for a charitable gift annuity? People over 70 years of age.

Who’s eligible to make a charitable roll-over gift from an I.R.A? People over 70 years of age.

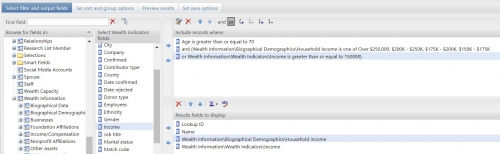

It’s easy to create a query isolating your constituents over age 70 if you haven’t already invested in an age overlay service. If you don’t already know the age of each of your constituents, WealthPoint also returns age data. Coupled with income and asset information you can easily find your best constituent prospects.

- For I.R.A. roll-over marketing, I’d look for records with high income.

- For charitable gift annuity marketing, I’d do the opposite and look for mid-to-high asset holders with a lower income!

Finding Records for I.R.A. Rollover Gift Marketing in ResearchPoint

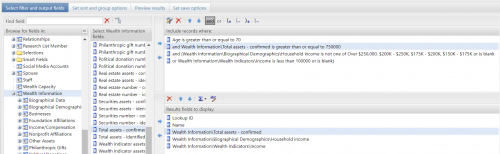

Prospecting for Charitable Remainder Trusts.

Who’s most likely to consider a CRT? People with hard-to-convert-to-cash or with income-producing property.

Traditional prospect research is the way to go here. Look for individuals ready to retire or just past retirement age (age 50-70) who have assets that aren’t producing interest or income or an asset that’s already producing income, but they may want to divest themselves from managing it. This includes stocks, businesses, commercial real property and the like. While a bit more complicated, the data is available, and your prospect researcher knows how to find it. Here’s how:

Finding Records for CRT Marketing in ResearchPoint

When you know what to look for and how to apply the right data, it’s easy to see why you can get off the fence and jump over to the “Yes!... Wealth Screenings ARE Useful for Planned Giving Programs!” side.

Remember if you need help with your Blackbaud software product you can get assistance from our expert Support Analysts. Start with a chat and let them know you’d like to learn how to prospect for planned gifts within your wealth screening results.

News

ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

04/10/2018 6:02pm EDT

Leave a Comment