Fiscal Year Refresher - Part 1: Soft Closing Vs. Hard Closing

Published

[caption id="attachment_5661" align="aligncenter" width="290"]

Image courtesy of Tommaso Galli.[/caption]

Image courtesy of Tommaso Galli.[/caption]We’re quickly approaching the end of many organizations’ fiscal year. This is a perfect opportunity to review how we close fiscal years. While The Financial Edge can retain an unlimited number of open fiscal years, there are two main reasons for closing your fiscal years; doing so will prevent data entry after your audit has been completed, and it will also speed up many of the financial reports. Today we'll take a look at the differences between soft closing and hard closing a fiscal year.

“Soft” Closing a Fiscal Year:

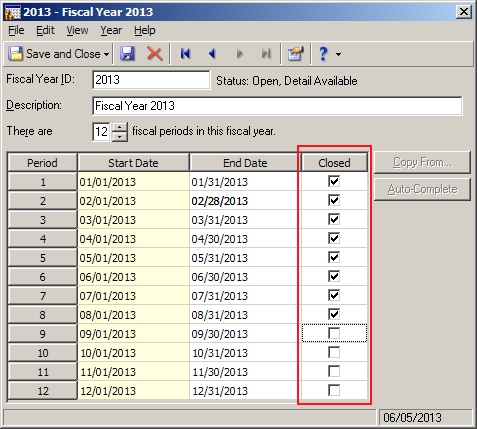

[caption id="attachment_5658" align="aligncenter" width="477"]

We can soft close fiscal years by using the check boxes shown.[/caption]

We can soft close fiscal years by using the check boxes shown.[/caption]The Financial Edge allows us to temporarily close a single fiscal period at a time by using a checkbox in Configuration > Fiscal Years. To soft close a fiscal year, you'd simply mark the Closed checkbox for all fiscal periods within that year. This is really handy because it is a completely reversible action. Note that a fiscal year with soft closed periods will still display as Open in Configuration since the status is describing the entire year itself, not the individual periods within. This is different from hard closing a fiscal year.

So why soft close a fiscal period? Many organizations soft close fiscal years prior to hard closing them as part of their policy in order to avoid inadvertently posting into them. If you need to wait for your CFO or auditor to give you the final thumbs up to actually close the year, this is a very prudent step to take. Furthermore, because many reports in the Financial Edge perform a mock close when run, we can still report accurately on Net Assets (or Fund Balance) information without actually rolling it forward through a hard close.

“Hard” Closing a Fiscal Year:

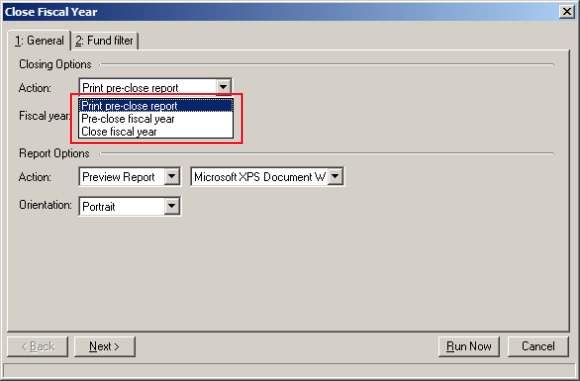

[caption id="attachment_5659" align="aligncenter" width="580"]

Hard close fiscal years using the wizard in Administration. Proceed through all three Actions shown in the drop-down above when you're ready![/caption]

Hard close fiscal years using the wizard in Administration. Proceed through all three Actions shown in the drop-down above when you're ready![/caption]We can also close fiscal years permanently, effectively writing them in stone. This is accomplished by using the Close fiscal years item within the General Ledger's Administration section three times in succession. This will allow you to run the Pre-Close Report, actually perform the Pre-Close process for the fiscal year, and finally actually close the fiscal year. Because it's not possible to undo this action, it is highly recommended that you make a backup of your database before hard closing. If you think you might need to make further entries in a fiscal year, you're not ready to hard close it just yet.

Why hard close a fiscal year, then? Hard closing actually commits your fiscal year and rolls forward your net surplus / deficit into the Net Assets (or Fund Balance) account. It doesn't get more locked down than that.

If you're looking for more information about end-of-year processes, take a look at our End-of-Year Guide for The Financial Edge (PDF). It covers processes you'll perform within the General Ledger, Accounts Payable, Payroll, and Student Billing modules.

Stay tuned for Part 2 where I'll discuss Optimizing, Summarizing, and Purging Fiscal Years!

News

ARCHIVED | Financial Edge® Tips and Tricks

06/06/2013 10:51am EDT

Leave a Comment