Updating Aatrix for Year-End Tax Reporting

Published

Can you believe it? The holiday season is already upon us and another annual event within The Financial Edge is happening, too. You've likely read our posts about installing and registering Aatrix, but we also must update our forms. Although the update is not currently available, it is almost time to update Aatrix forms for the 2014 tax year. This update includes both State and Federal Tax reports in both Accounts Payable and Payroll.

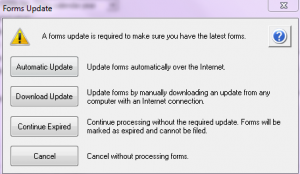

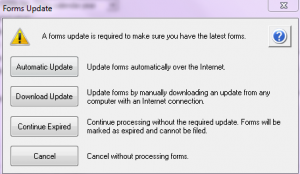

If this is not your first year using Aatrix, you may have come across quarterly updates throughout the year, such as those for the 941 reports, on your state reports in Payroll. This upcoming update pertains to 2014 W-2 and 1099 forms. Aatrix will be pushing out the update within the next few weeks and we want to ensure you are ready to go when it is time to process those W-2 and 1099 reports. When displaying the reports when the update is available, you will receive a prompt indicating it is time to update the forms. Be sure to click to update the tax forms to download the latest report forms.

If you are unfamiliar with Aatrix and have never had to install or update, that’s okay! Check out our prior blog "How to Install Aatrix Tax Reports." We also have some great additional documentation on installing and updating Aatrix.

Check out our Aatrix web seminars that will guide you through the process: December 16th, 2014 at 3:00 PM ET and then also January 8, 2015 at 3:00 PM ET.

If this is not your first year using Aatrix, you may have come across quarterly updates throughout the year, such as those for the 941 reports, on your state reports in Payroll. This upcoming update pertains to 2014 W-2 and 1099 forms. Aatrix will be pushing out the update within the next few weeks and we want to ensure you are ready to go when it is time to process those W-2 and 1099 reports. When displaying the reports when the update is available, you will receive a prompt indicating it is time to update the forms. Be sure to click to update the tax forms to download the latest report forms.

If you are unfamiliar with Aatrix and have never had to install or update, that’s okay! Check out our prior blog "How to Install Aatrix Tax Reports." We also have some great additional documentation on installing and updating Aatrix.

Check out our Aatrix web seminars that will guide you through the process: December 16th, 2014 at 3:00 PM ET and then also January 8, 2015 at 3:00 PM ET.

News

ARCHIVED | Financial Edge® Tips and Tricks

12/02/2014 6:00am EST

Leave a Comment