W-2 Processing Tips

Published

As you all know, it’s time to process those W-2s again. In order to help successfully complete your W-2s, I wanted to go over a few helpful tools with you. We can all be more prepared for deadlines by making any W-2 corrections ahead of time. W-2 information can be verified by reviewing records, reports, and settings in Configuration.

One report most commonly used is the Adjusted Gross Wage Report. It reports on all adjusted wage amounts for each payroll calculation along with a grand total on the bottom. This report can be used to help payroll administrators verify the adjusted gross used to calculate taxes and verify W-2 information. You have the option to include paid and/or unpaid calculations. Remember, if pay types are set to 'Report only no withholding,' they will not be reflected on employee records, but will show on the reports. We also recommend this report after making any tax adjustments. Visit the link below to see which other reports/areas are best suited to reconcile W-2 information:

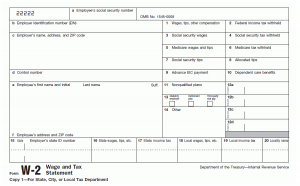

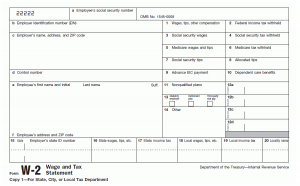

If after running your reports you find you need to adjust taxes for employees, historical entries will need to be made. I wanted to point out a very useful tool we have to aid in this process – our W-2 Wizard. This tool makes tax adjustments less intimidating by walking you through step by step instructions specific to the box(es) you need to adjust. You will simply click on the individual box needing to be increased or decreased and follow the outlined instructions and screen shots on how to modify that section of the W-2. Below is a screen shot of our Wizard:

We also offer an online, instructor-led class called End of Year in Payroll - W2 Preparation and Distribution. To register, click the preceding link. To search for other classes, click here.

One report most commonly used is the Adjusted Gross Wage Report. It reports on all adjusted wage amounts for each payroll calculation along with a grand total on the bottom. This report can be used to help payroll administrators verify the adjusted gross used to calculate taxes and verify W-2 information. You have the option to include paid and/or unpaid calculations. Remember, if pay types are set to 'Report only no withholding,' they will not be reflected on employee records, but will show on the reports. We also recommend this report after making any tax adjustments. Visit the link below to see which other reports/areas are best suited to reconcile W-2 information:

If after running your reports you find you need to adjust taxes for employees, historical entries will need to be made. I wanted to point out a very useful tool we have to aid in this process – our W-2 Wizard. This tool makes tax adjustments less intimidating by walking you through step by step instructions specific to the box(es) you need to adjust. You will simply click on the individual box needing to be increased or decreased and follow the outlined instructions and screen shots on how to modify that section of the W-2. Below is a screen shot of our Wizard:

We also offer an online, instructor-led class called End of Year in Payroll - W2 Preparation and Distribution. To register, click the preceding link. To search for other classes, click here.

News

ARCHIVED | Financial Edge® Tips and Tricks

01/07/2015 6:00am EST

Leave a Comment