Correcting 1099 Amounts

Published

When reviewing your 1099 Activity Report, you may come across amounts that are lower or higher than expected for a vendor. We see this happen when one or more of the following scenarios occurs:

Both marking a vendor as a 1099 vendor and entering 1099 distribution on the vendor record are not retroactive changes and therefore will not adjust your past invoices. If either of these changes took place after invoices were created, or for any other reason causing 1099 amounts to be incorrect, an adjustment must be made to correct the 1099 amounts.

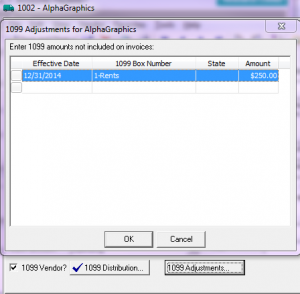

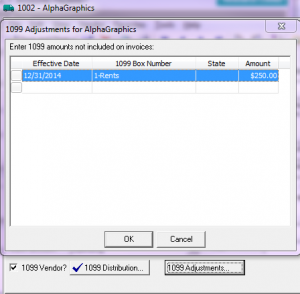

Adjustments are made from the Vendor record by clicking the 1099 adjustments button on the bottom of the Vendor tab. When entering adjustments, you select a date within the reporting period. The next step is choosing a 1099 Box number and State (if applicable). In the amount column, enter a positive number to increase or a negative number decrease the 1099 values by a specific amount. Note: You are entering how much you are increasing or decreasing the reporting values, not the total amount to report. After clicking OK and choosing to Save and Close the Vendor, you can see the updated amounts by running a 1099 activity report. Below is a screen shot of an example where I needed to increase box 1-Rents for $250:

Multiple adjustments may be entered, but it may save time if all invoices are distributed to one box to simply do one lump sum adjustment. Would you like to see a list of vendors paid over a certain amount to compare against the 1099 report? I recommend running a Vendor query to list this information. Click here to see outlined steps and view a video-demo on this query’s set-up. By comparing the query results of total amount paid within the year with the 1099 activity report, you will be able to calculate adjustment amounts where necessary.

For more information, be sure to check out the links below and subscribe to our blogs:

End-of-Year Guide

How to adjust 1099 amounts

How to adjust only the state box on 1099

- The vendor was marked as a 1099 vendor mid-year and no adjustments were made for prior invoices.

- Default 1099 distribution was entered mid-way through the year.

- Although marked as a 1099 Vendor, no default distribution was entered in the Vendor records’ 1099 distribution box and no 1099 distribution was entered manually on the invoice.

- Unless a default 1099 distribution is set up on the Vendor record, when entering invoices you must manually enter distribution. The default distribution can be viewed, added or modified at the bottom of Vendor tab on the Vendor record by clicking 1099 distribution.

- The default 1099 distribution was removed from an invoice at time of entry.

- The 1099 distribution was entered or modified incorrectly when creating an invoice.

Both marking a vendor as a 1099 vendor and entering 1099 distribution on the vendor record are not retroactive changes and therefore will not adjust your past invoices. If either of these changes took place after invoices were created, or for any other reason causing 1099 amounts to be incorrect, an adjustment must be made to correct the 1099 amounts.

Adjustments are made from the Vendor record by clicking the 1099 adjustments button on the bottom of the Vendor tab. When entering adjustments, you select a date within the reporting period. The next step is choosing a 1099 Box number and State (if applicable). In the amount column, enter a positive number to increase or a negative number decrease the 1099 values by a specific amount. Note: You are entering how much you are increasing or decreasing the reporting values, not the total amount to report. After clicking OK and choosing to Save and Close the Vendor, you can see the updated amounts by running a 1099 activity report. Below is a screen shot of an example where I needed to increase box 1-Rents for $250:

Multiple adjustments may be entered, but it may save time if all invoices are distributed to one box to simply do one lump sum adjustment. Would you like to see a list of vendors paid over a certain amount to compare against the 1099 report? I recommend running a Vendor query to list this information. Click here to see outlined steps and view a video-demo on this query’s set-up. By comparing the query results of total amount paid within the year with the 1099 activity report, you will be able to calculate adjustment amounts where necessary.

For more information, be sure to check out the links below and subscribe to our blogs:

End-of-Year Guide

How to adjust 1099 amounts

How to adjust only the state box on 1099

News

ARCHIVED | Financial Edge® Tips and Tricks

01/05/2015 6:00am EST

Leave a Comment