Working In The 1099 Grid In Aatrix

Published

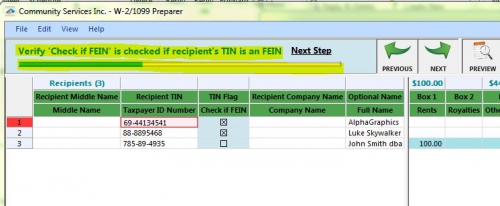

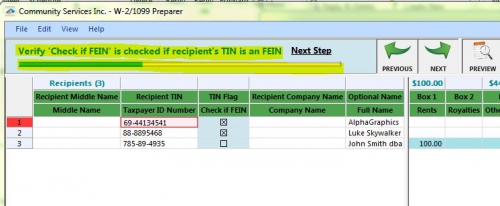

Once you’ve confirmed your 1099 amounts are correct and installed Aatrix, you’re ready to review the data that pulled into the 1099 Grid after selecting to ‘Display Report’ and completing the specific tax information. We can make some adjustments in the grid to make it easier to read and review.

When you are on the W2/1099 Preparer Grid, you will notice the grid is sectioned off. You can drag the divider to expand or hide one of the sections. To drag the divider, hover your mouse over the divider until the around displays “<–>”. You can then click and drag as desired. Another tip to customize your view is moving the columns to your preferred order. By right clicking the green column header, you may choose to move a row to the left or right.

Are the Vendors not in order? No problem! Just right click on the ‘Full Name’ header title and select ‘Sort rows by…’ You can change this throughout your time in working in the grid. You can also remove rows or insert rows by right-clicking on the number for that row and selecting ‘Remove row’ or ‘Insert row.’

Keep in mind that the format of the Taxpayer ID number comes from the Vendor Type of Organization or Individual selected on the Vendor tab of the Vendor record in Accounts Payable. If a Vendor record wasn’t changed, it will be organization (**-*******) instead of individual (***-**-****).

Have you not received a vendor TIN? You may mark the 2nd TIN Not./Second TIN notice box (last column) to indicate you do not yet have the Vendor TIN. Otherwise, you may be alerted that a valid TIN must be entered. This box must be marked in order to proceed with an empty TIN field.

Why am I clicking ‘Next’ so many times? The 1099 Grid asks you to confirm each column type one at a time and click 'Next'. Yes, you can view all of the data without doing that, but you will see at the top left what field it is confirming for accuracy in format and tax standards.

Reviewing all of the information in the grid to your totals from FE can be time consuming. You may find yourself taking a break or moving on to another task. By clicking File > Save within the grid, you can choose to save the grid as a work-in-progress. When you are ready to pick up where you left off, once you choose Display Report from Mail > Forms > 1099 Forms, you will be asked if you want to use your work-in-process.

If you find you are missing any data or have incorrect amounts, we recommend taking note of all of the information and updating the record in The Financial Edge. Entering corrections in the 1099 grid will NOT update the records and information in The Financial Edge. However, updating the records in The Financial Edge, will update the grid as long as you don’t select to use your ‘work-in-progress’. You’d have to ‘Start Over’ to have the grid refresh with edited data from The Financial Edge.

The above information is a high level overview of the 1099 Preparer Grid. We will have Webinars throughout the season so make sure to check them out for live video demos and Q&A! The schedule will be updated regularly, so keep an eye out for additional dates as we move through the season!

For additional information please see the following links and be sure to click ‘Subscribe to this Blog’ at the top right to keep up to date with all of the latest Tax Season tips and information!

End of Year FAQ’s

Community Tax Season homepage

Have you registered Aatrix yet? Make sure your Aatrix registration is up to date before printing your Tax Forms!

When you are on the W2/1099 Preparer Grid, you will notice the grid is sectioned off. You can drag the divider to expand or hide one of the sections. To drag the divider, hover your mouse over the divider until the around displays “<–>”. You can then click and drag as desired. Another tip to customize your view is moving the columns to your preferred order. By right clicking the green column header, you may choose to move a row to the left or right.

Are the Vendors not in order? No problem! Just right click on the ‘Full Name’ header title and select ‘Sort rows by…’ You can change this throughout your time in working in the grid. You can also remove rows or insert rows by right-clicking on the number for that row and selecting ‘Remove row’ or ‘Insert row.’

Keep in mind that the format of the Taxpayer ID number comes from the Vendor Type of Organization or Individual selected on the Vendor tab of the Vendor record in Accounts Payable. If a Vendor record wasn’t changed, it will be organization (**-*******) instead of individual (***-**-****).

Have you not received a vendor TIN? You may mark the 2nd TIN Not./Second TIN notice box (last column) to indicate you do not yet have the Vendor TIN. Otherwise, you may be alerted that a valid TIN must be entered. This box must be marked in order to proceed with an empty TIN field.

Why am I clicking ‘Next’ so many times? The 1099 Grid asks you to confirm each column type one at a time and click 'Next'. Yes, you can view all of the data without doing that, but you will see at the top left what field it is confirming for accuracy in format and tax standards.

Reviewing all of the information in the grid to your totals from FE can be time consuming. You may find yourself taking a break or moving on to another task. By clicking File > Save within the grid, you can choose to save the grid as a work-in-progress. When you are ready to pick up where you left off, once you choose Display Report from Mail > Forms > 1099 Forms, you will be asked if you want to use your work-in-process.

If you find you are missing any data or have incorrect amounts, we recommend taking note of all of the information and updating the record in The Financial Edge. Entering corrections in the 1099 grid will NOT update the records and information in The Financial Edge. However, updating the records in The Financial Edge, will update the grid as long as you don’t select to use your ‘work-in-progress’. You’d have to ‘Start Over’ to have the grid refresh with edited data from The Financial Edge.

The above information is a high level overview of the 1099 Preparer Grid. We will have Webinars throughout the season so make sure to check them out for live video demos and Q&A! The schedule will be updated regularly, so keep an eye out for additional dates as we move through the season!

For additional information please see the following links and be sure to click ‘Subscribe to this Blog’ at the top right to keep up to date with all of the latest Tax Season tips and information!

End of Year FAQ’s

Community Tax Season homepage

Have you registered Aatrix yet? Make sure your Aatrix registration is up to date before printing your Tax Forms!

News

ARCHIVED | Financial Edge® Tips and Tricks

12/20/2017 9:00am EST

Leave a Comment