How to create 1099's

Published

In a previous blog, How to find and Correct 1099 Activity, we discussed how to review and correct 1099 information for qualified Vendors. In this blog we will discuss the steps to create and produce the 1099 forms once all corrections have been made.

If you processed 1099 forms with us last year you are probably familiar with the term Aatrix preparer grid. For those of you who are processing 1099’s with us for the first time let me explain what this term means. The Aatrix preparer grid is what is used to process your 1099 forms. The actual 1099 information is entered in Financial Edge but then processed through Aatrix. The information that you see generated on the Aatrix 1099 preparer grid is information that is pulled directly from Financial Edge.

Now that that’s been cleared up let’s go ahead and take steps to generate a 1099 form.

How to create a 1099 Forms:

Once the General tab has been filled out go ahead and click Display Report located on the bottom right hand corner.

If you have already worked on 1099 information this year you will be taken straight to the 1099 Aatrix preparer grid and you can pass over the next bit of information.

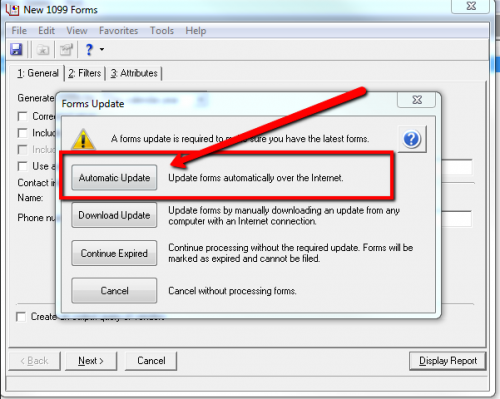

If this is your first time processing 1099’s with us, or you haven’t already updated Aatrix for the 2015 year, you may receive a prompt to update (see below). The option you will want to choose here is Automatic Update.

**Note- if you click on Display report and nothing happens minimize the Financial Edge. Often times the Forms update pops up behind the application**

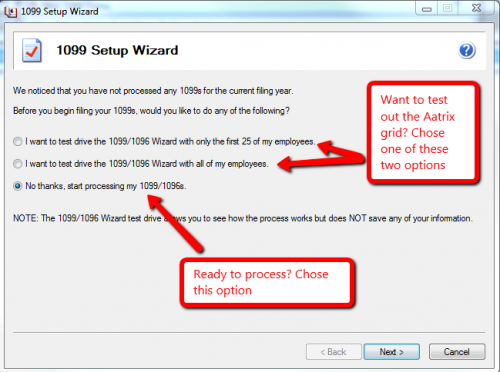

Once the update is complete you will then be taken to the 1099 Setup Wizard. If this is your first time using the Aatrix preparer grid you have the option to test drive. If you haven’t processed 1099’s with us before I would suggest this option just to get familiar with it. If this isn’t your first rodeo go ahead and choose “No thanks, start processing my 1099s/ 1096’s”.

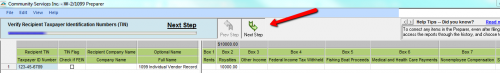

Whether you chose to test drive or not you will have to continue through the 1099 Setup Wizard by clicking on Next and filling in the appropriate information. Once completed you will be taken to the 1099 Preparer Grid. Use the Next Step button to move through the Grid. If any corrections need to be made you will receive a warning and will be required to make the necessary revisions.

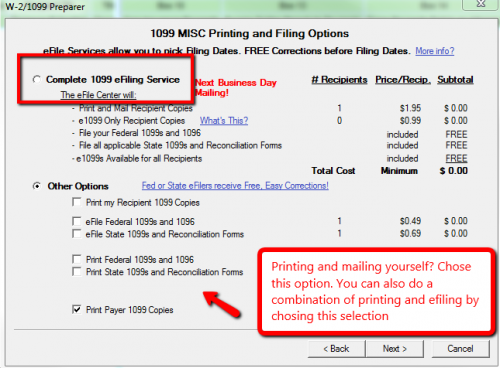

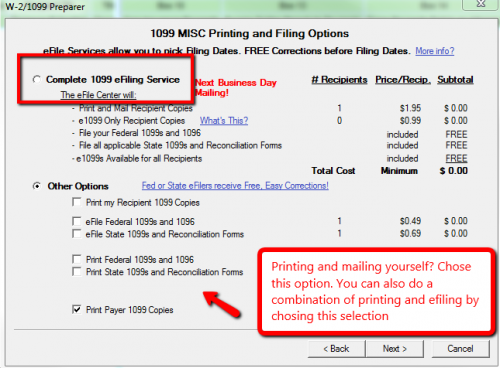

Once you’ve gone all the way through the grid you will be asked how you want to process your 1099’s. The two options are to “Complete 1099 eFiling Service” or choose “Other Options”. Choosing to Efile means you will Efile all copies of the form. This will be done through Aatrix with an associated cost. The “Other Options” selection gives you the option of printing and mailing these forms yourself or a combination of printing and efiling.

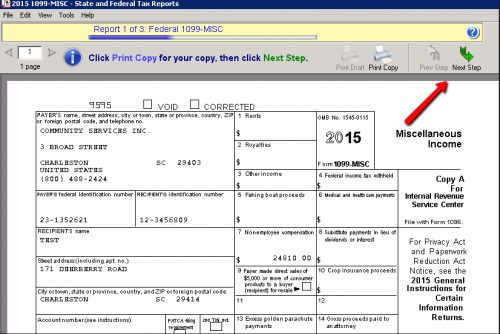

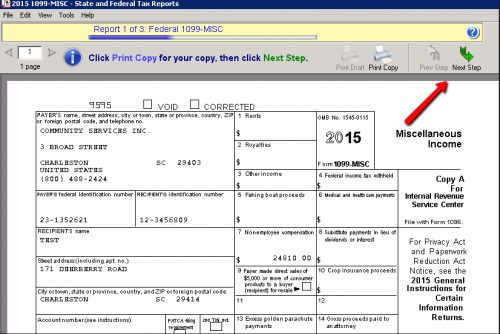

If you choose to Efile your forms will be sent to and processed by Aatrix, more information can be found on the Aatrix eFiling website. If you select “Other Options” you will be taken to a preview of your 1099 forms. From here, if you want to print and mail these forms yourself, you will choose Print Final.

**Please note that the forms are printed a copy at a time for all recipients meaning if the preview shows Copy A this means that all recipient’s Copy A will be printed first. Then clicking Next Step will give you a preview of a second Copy where all recipients will be printed. **

Once all forms have been either printed or eFiled then your 1099 processing has been completed!

For more information on creating 1099 forms please refer to the following Knowledgebase article: How to print and prepare 1099 forms in Aatrix in Accounts Payable 7

If you processed 1099 forms with us last year you are probably familiar with the term Aatrix preparer grid. For those of you who are processing 1099’s with us for the first time let me explain what this term means. The Aatrix preparer grid is what is used to process your 1099 forms. The actual 1099 information is entered in Financial Edge but then processed through Aatrix. The information that you see generated on the Aatrix 1099 preparer grid is information that is pulled directly from Financial Edge.

Now that that’s been cleared up let’s go ahead and take steps to generate a 1099 form.

How to create a 1099 Forms:

- Go to Mail

- Click on Forms

- Highlight 1099 Forms

- Select New

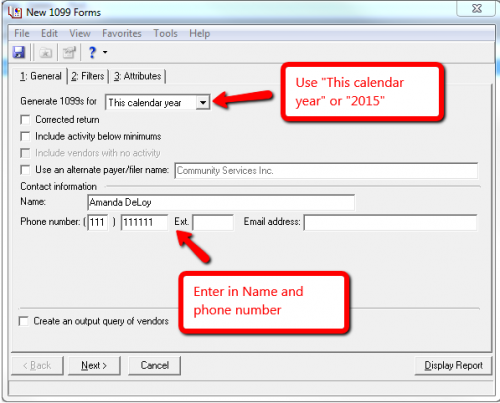

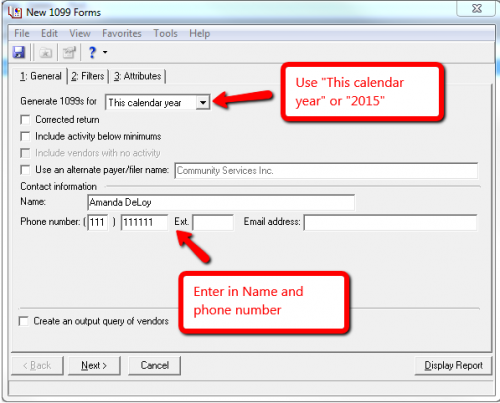

- In the “Generate 1099’s for” drop down ensure that “This Calendar Year” or “2015” is selected

- Enter information in all required fields (Name and Phone number)

Once the General tab has been filled out go ahead and click Display Report located on the bottom right hand corner.

If you have already worked on 1099 information this year you will be taken straight to the 1099 Aatrix preparer grid and you can pass over the next bit of information.

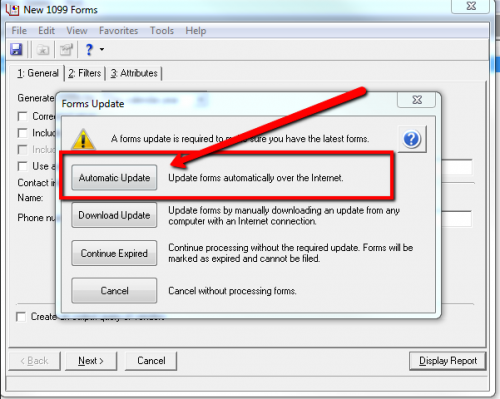

If this is your first time processing 1099’s with us, or you haven’t already updated Aatrix for the 2015 year, you may receive a prompt to update (see below). The option you will want to choose here is Automatic Update.

**Note- if you click on Display report and nothing happens minimize the Financial Edge. Often times the Forms update pops up behind the application**

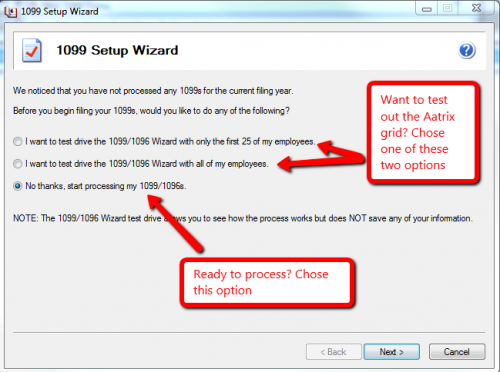

Once the update is complete you will then be taken to the 1099 Setup Wizard. If this is your first time using the Aatrix preparer grid you have the option to test drive. If you haven’t processed 1099’s with us before I would suggest this option just to get familiar with it. If this isn’t your first rodeo go ahead and choose “No thanks, start processing my 1099s/ 1096’s”.

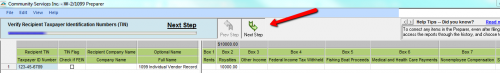

Whether you chose to test drive or not you will have to continue through the 1099 Setup Wizard by clicking on Next and filling in the appropriate information. Once completed you will be taken to the 1099 Preparer Grid. Use the Next Step button to move through the Grid. If any corrections need to be made you will receive a warning and will be required to make the necessary revisions.

Once you’ve gone all the way through the grid you will be asked how you want to process your 1099’s. The two options are to “Complete 1099 eFiling Service” or choose “Other Options”. Choosing to Efile means you will Efile all copies of the form. This will be done through Aatrix with an associated cost. The “Other Options” selection gives you the option of printing and mailing these forms yourself or a combination of printing and efiling.

If you choose to Efile your forms will be sent to and processed by Aatrix, more information can be found on the Aatrix eFiling website. If you select “Other Options” you will be taken to a preview of your 1099 forms. From here, if you want to print and mail these forms yourself, you will choose Print Final.

**Please note that the forms are printed a copy at a time for all recipients meaning if the preview shows Copy A this means that all recipient’s Copy A will be printed first. Then clicking Next Step will give you a preview of a second Copy where all recipients will be printed. **

Once all forms have been either printed or eFiled then your 1099 processing has been completed!

For more information on creating 1099 forms please refer to the following Knowledgebase article: How to print and prepare 1099 forms in Aatrix in Accounts Payable 7

News

ARCHIVED | Financial Edge® Tips and Tricks

12/31/2015 1:06pm EST

Leave a Comment

W-2/1099/ACA Employee/Recipient Copy Date: Jan 29th 3:00 PM CST

W-2/1099/ACA Federal Date: Mar 29 3:00 PM CST

(Subject to change.)

Thanks!