Matching Gifts

Published

Hello my friends! How many of you like donations? Go on and raise your hand. No one is looking. Everyone reading this should have their hand up. Now how many of you like two donations? Now you should have both of your hands up. Today we are talking Matching Gifts.

It is not uncommon for a constituent to donate to an organization and have the company they work for match the donation. This is great for your organization because it is an extra transaction with usually little work involved; it also opens new doors with the businesses doing the matching, creating new relationships and opportunities for future donations.

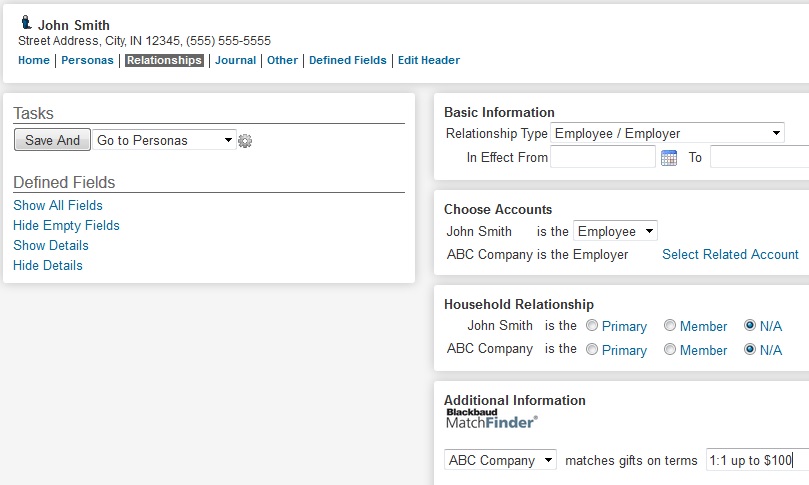

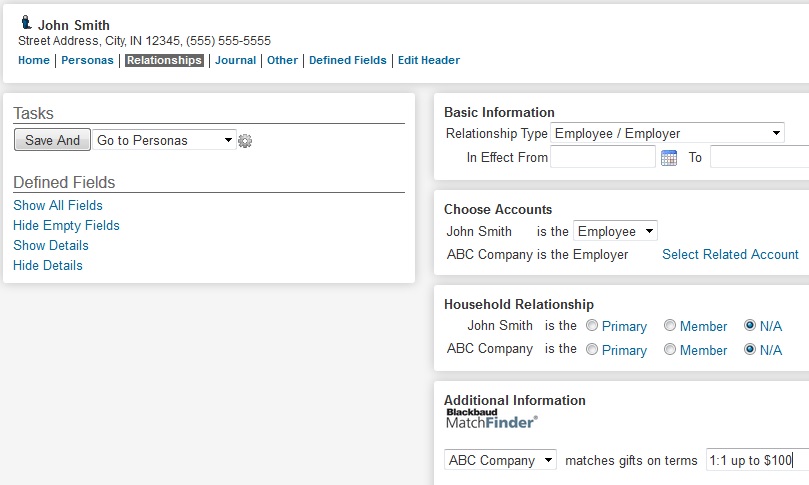

So the big question is, “how do we track matching gifts in the database?” Well first you are going to need to know which of your constituents work with a company that has a matching gift program. So if John Smith works for ABC Company, the first thing to do is to create a constituent record for both John and ABC Company. Then, create a new relationship type called Employer/Employee (or something similar) if you don’t already have one. This relationship type can then be used to link John Smith’s account to the ABC Company. While you are creating this relationship between the two accounts, there is a section at the bottom of the page called Additional Information. Here you can enter in which of the two accounts will match (ABC Company) and for how much. An example would be “ABC Company matches gifts on terms 1:1 up to $100.”

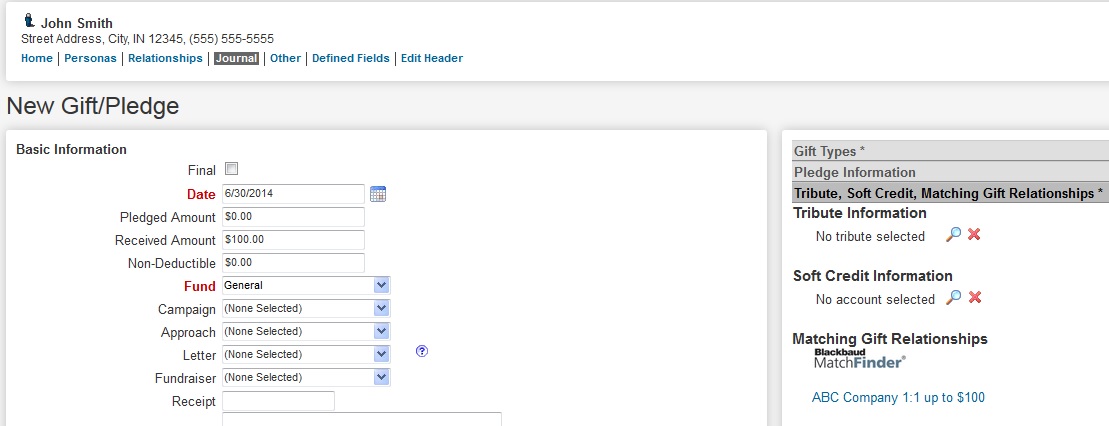

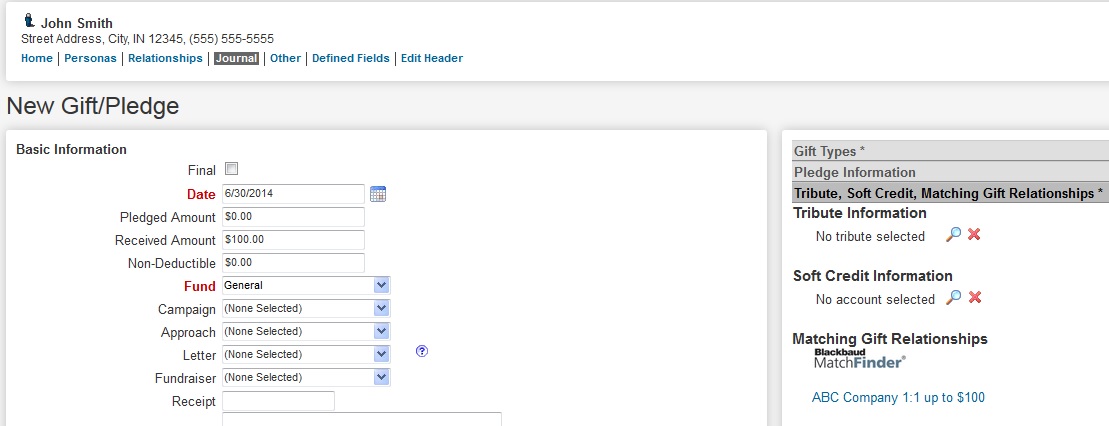

Once you have the relationship setup, you just need John Smith to make a donation. If John Smith makes a $100 donation, you would enter that in just like a normal Gift entry. However, when adding the donation you can now click on the Tribute, Soft Credit, Matching Gift Relationships tab on the right hand side of the gift entry. This is where you’ll see the matching gift terms you entered on the relationship displayed. Now that we see John Smith has a company that will match his donation, you can now contact that company to solicit that matching donation!

Once you receive the matching gift (hooray!), before it is entered into your database some database administration will need to be performed first. You’ll need to create an Approach called Matching Gift, which you can then select on the transaction you add to the ABC Company’s account. This will help you differentiate between donations from the ABC Company that were matching gifts, and gifts that the company gave outright.

The method for adding the matching donation to the company’s account actually differs from how you added the original donation to John Smith’s account. Instead of creating a single gift for the amount of the matching donation, you can create a Pledge entry of $100 (since they match 1:1 up to $100). You would actually add this as soon as you saw that the ABC Company matches the gift on a 1:1 basis (when you first added John’s gift). Since ABC Company hasn’t actually given you their $100 matching gift yet, you’ll want to create a Pledge until they do, which will allow you to track going forward which companies have fulfilled their matching gifts and which ones have not. Be sure you set the Approach of the pledge to Matching Gift.

While you are setting up the pledge you can also Soft Credit John Smith. ABC Company wouldn’t be giving your organization this $100 matching gift if it wasn’t for John Smith’s original donation, and by crediting John Smith you can both recognize the role he played in bring that donation to your organization, and send him thank you letters for the money he helped raise.

So to recap, you’ll want to create a relationship between any employee and their employer that has a matching gift program, using the Employee/Employer relationship type. You record the employee’s donation just like normal, and then you create a Pledge entry on the employer’s account for the amount they match. It is also a good idea to soft credit the employee to give them credit for the matching gift. When the employer sends you the money you can add a payment to the pledge to pay it off.

For more information, check out our Help section and Knowledgebase. I’ve included some links throughout the blog and below are a few resources as well.

Resources:

Matching Gifts Help Document – Click Here

It is not uncommon for a constituent to donate to an organization and have the company they work for match the donation. This is great for your organization because it is an extra transaction with usually little work involved; it also opens new doors with the businesses doing the matching, creating new relationships and opportunities for future donations.

So the big question is, “how do we track matching gifts in the database?” Well first you are going to need to know which of your constituents work with a company that has a matching gift program. So if John Smith works for ABC Company, the first thing to do is to create a constituent record for both John and ABC Company. Then, create a new relationship type called Employer/Employee (or something similar) if you don’t already have one. This relationship type can then be used to link John Smith’s account to the ABC Company. While you are creating this relationship between the two accounts, there is a section at the bottom of the page called Additional Information. Here you can enter in which of the two accounts will match (ABC Company) and for how much. An example would be “ABC Company matches gifts on terms 1:1 up to $100.”

Once you have the relationship setup, you just need John Smith to make a donation. If John Smith makes a $100 donation, you would enter that in just like a normal Gift entry. However, when adding the donation you can now click on the Tribute, Soft Credit, Matching Gift Relationships tab on the right hand side of the gift entry. This is where you’ll see the matching gift terms you entered on the relationship displayed. Now that we see John Smith has a company that will match his donation, you can now contact that company to solicit that matching donation!

Once you receive the matching gift (hooray!), before it is entered into your database some database administration will need to be performed first. You’ll need to create an Approach called Matching Gift, which you can then select on the transaction you add to the ABC Company’s account. This will help you differentiate between donations from the ABC Company that were matching gifts, and gifts that the company gave outright.

The method for adding the matching donation to the company’s account actually differs from how you added the original donation to John Smith’s account. Instead of creating a single gift for the amount of the matching donation, you can create a Pledge entry of $100 (since they match 1:1 up to $100). You would actually add this as soon as you saw that the ABC Company matches the gift on a 1:1 basis (when you first added John’s gift). Since ABC Company hasn’t actually given you their $100 matching gift yet, you’ll want to create a Pledge until they do, which will allow you to track going forward which companies have fulfilled their matching gifts and which ones have not. Be sure you set the Approach of the pledge to Matching Gift.

While you are setting up the pledge you can also Soft Credit John Smith. ABC Company wouldn’t be giving your organization this $100 matching gift if it wasn’t for John Smith’s original donation, and by crediting John Smith you can both recognize the role he played in bring that donation to your organization, and send him thank you letters for the money he helped raise.

So to recap, you’ll want to create a relationship between any employee and their employer that has a matching gift program, using the Employee/Employer relationship type. You record the employee’s donation just like normal, and then you create a Pledge entry on the employer’s account for the amount they match. It is also a good idea to soft credit the employee to give them credit for the matching gift. When the employer sends you the money you can add a payment to the pledge to pay it off.

For more information, check out our Help section and Knowledgebase. I’ve included some links throughout the blog and below are a few resources as well.

Resources:

Matching Gifts Help Document – Click Here

News

ARCHIVED | Blackbaud eTapestry® Tips and Tricks

07/01/2014 9:00am EDT

Leave a Comment