Guide To FIMS Year End Procedures

Published

Along with financial procedures such as End of Year closing in General Ledger, there are non-financial procedures that you may wish to run at the end of the year as well.

Before Running End of Year Closing

If you need to retire funds, you should do so before running the end of year closing in General Ledger. The best time to retire a fund is when the fund balance is zero. When you retire a fund, FIMS will automatically mark the associated GL accounts as inactive – this will keep those accounts from being created in the new GL year. You can access this feature from anywhere in FIMS by going to File Maintenance>Funds>Retire a Fund.

If you are planning to clean up your GL account structure and auto-building setup, you should also do that before running End of Year Closing.

Overview for End of Year Closing

The GL End of Year Closing utility does not actually “close” the year. It performs the following functions:

- Creates a set of General Ledger Account records for the new year, based on the current year’s accounts.

- Establishes the beginning balances for the balance sheet accounts in the new year.The ending balance for the old year automatically becomes the beginning balance for the new year.

- Closes the revenue and expense accounts to the fund balance accounts in the new year.

- Clears the beginning balance for revenue and expense accounts in the new year.

One thing to understand is that you can run this procedure multiple times. At a minimum you may want to run it at least three times: 1) first before the end of the year to create GL accounts for the new year so that you can begin processing and entering budget numbers; 2) around the end of the year so beginning balances are updated for the new year; and 3) one last time after the audit is done and adjusting entries have been posted.

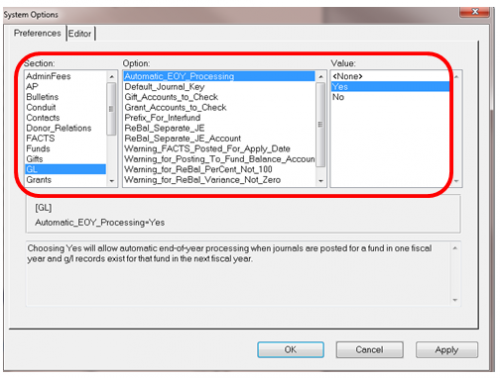

There is an automatic way to run the End of Year Closing utility each time you post journal entries in General Ledger. This ensures that you are always updating the beginning balances in the new year. To access this option from anywhere in FIMS go to Tools>System Utilities>System Options. Choose GL under Section, Automatic EOY Processing under Option and click on Yes in Value. Be sure to click on the Apply button and you will have enabled Automatic EOY Processing.

Other Financial Year End Considerations

Close Modules by Date

The Close Modules by Date utility prevents the system from posting any journal entries that fall on or before the selected date (generally the last day of the last audited year). If you ever need to reopen a year to add entries, you can remove the date or set it back a year by running the utility again. This utility is available from anywhere in FIMS by going to File Maintenance>General Ledger>Close Modules by Date.

Rolling Targets Forward

If you use Asset Rebalancing, and have run End of Year Closing at least once, you will need to copy Targets from the old year into the new year accounts. This utility can be found in General Ledger in the Asset Rebalancing> Processing tab>Copy Prior Year Targets.

Updating Future Years Accounts

The Update Future Years Accounts utility works in conjunction with the option to create future years grants payable accounts in GL and the Fund Class record. If you are using this feature in FIMS as you are approving and posting grant applications any payments that are due during the current year are posted to the current year grants payable account and any payments that are due in a future year will be posted to the future year grants payable account.

You should run this utility at the beginning of each year. It will create adjusting journal entries to move any amounts that were posted to the future years accounts but are now due to be paid out in the new year into the regular grants payable account. This utility can be found at File Maintenance>Accounts Payable>Update Future Years Accounts.

Reconciliation Reports

- General Ledger>Reconcile Subsidiary Modules with GL

This is a great report to make sure that you are staying in sync between your General Ledger, Gift, Grant and Accounts Payable modules. Before you run this report make sure that all journal entries in GL have been posted otherwise you may see variances on the report. The first time you run this report you will need to indicate which GL accounts to be used, however FIMS will remember them for the next time that you run this. We do recommend running this report at least quarterly.

- Accounts Payable>Payables As of a Past Date

This is a report that auditors often want so that they can compare the open items in Accounts Payable to the consolidated trial balance in General Ledger. The total open items should match the accounts payable account balance in General Ledger.

- FACTS>FACTS to GL Comparison Report

This report checks that the pool balances in FACTS are exactly the same as those tracked by the pooled asset account in General Ledger. This report displays the FACTS balance, the general ledger balance and the variance (which should be zero)

- Grants>Outstanding Grants by Fund Report

This report lists outstanding commitments before and after a user defined date range, along with any new grants that were approved and any payments that were made during the given date range. The fourth column, Commitments Outstanding as of the end of the year specified should match your ending grants payable balance in General Ledger.

- Pledges>Aged Trial Balance w/As of Date

This report is similar to the Accounts Payable “Payables as of a Past Date” report since it will show you pledge receivable as of the date you specify and should also match your consolidated trial balance.

Forwarding Grant Numbers

If you control your grant application numbering system so that the first four digits represent the year, you will need to set up a new grant number on January 1st of each year. You can access this tool from Tools>System Utilities>Set Automatic Numbers.

Auto-Creating Grant Applications

If you have designated or other types of grants that you routinely pay every year, you can use the Auto-Create Grant Applications utility to copy designated grant applications from the prior year and automatically create applications for the new year, saving data entry time. Before you run the utility, you will need to have a method to select which applications to copy. This utility can be accessed from File Maintenance>Grants.

Creating Recurring Grants from Fund Distributions

Another way to auto create grant applications is to use Recurring Grants from Fund Distributions also located under File Maintenance for Grants. This utility does not copy applications from history. Instead it creates applications based on information you have put in the fund distribution record in the Fund Module. This feature can insert a flat amount or a percentage of the available to spend amount that you have calculated for the year.

Recurring Tickles

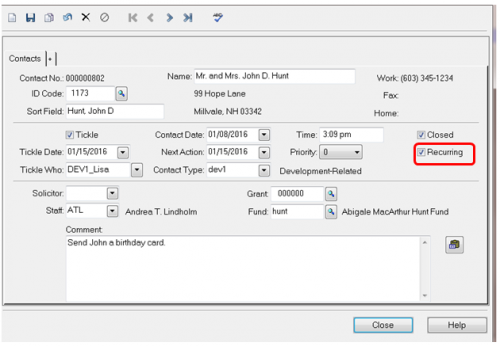

The last thing that you may need to do is forward the dates for any recurring tickles that you have set up. See below for an example of a recurring tickle. This one is a reminder to send a birthday card to a donor. If you have checked the Recurring box the utility will forward the Tickle Date field to January 15, 2017.

For additional information about the items covered in this article please refer to KB Article 26309 on Community. There is a video demonstration detailing how to perform the end of year items as well as a reference document that can be downloaded.

News

ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

10/12/2016 11:40am EDT

Leave a Comment