Resources for Producing Tax Receipts for Canadian Organizations

Geoff Arbuckle

Blackbaud Employee

While eReceipting is available for organizations across the world, this is vital for Canadian organizations. Included in this blog post will be some resource links to help these organizations get their tax receipts generated within eTapestry.Hello eTappers, Geoff here. I certainly hope you had a fantastic holiday season and are ready to hit the ground running here in 2025. In this blog about generating tax receipts, I'm going to be speaking directly to my friends in the lovely country of Canada. Don't worry, everyone else, I'll be publishing a separate blog for you, providing resources and a few tips for generating tax documents. But for this one, we're going to look specifically at a very important detail for Canadian users.

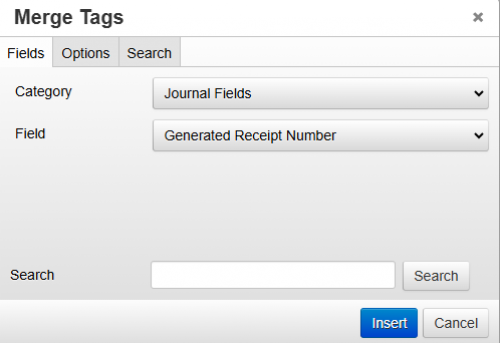

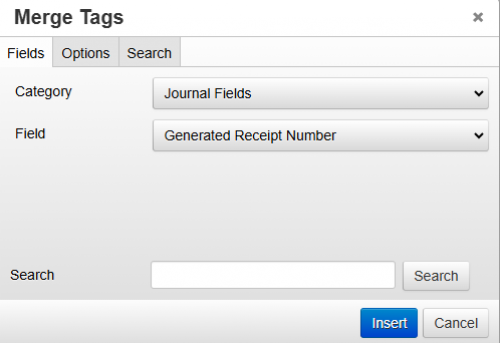

As you're likely well aware, Canadian tax laws require you to have receipt numbers assigned to each of your charitable gifts and shown on the receipts printed or sent to your donors. To help with this, eTapestry has a feature built into the database called eReceipts. In order to trigger this feature, you must make sure that your communication template includes the Merge Tag for "Generated Receipt Number." It is found in Journal Fields as demonstrated below:

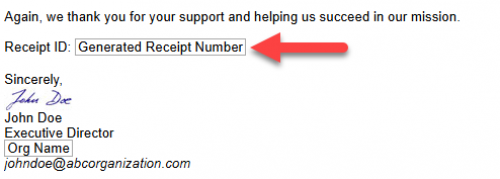

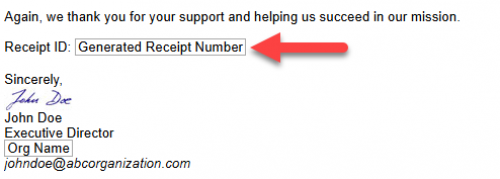

Once it appears in the template's edit step, it will appear as such:

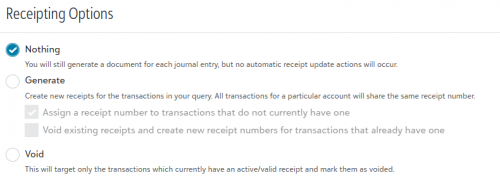

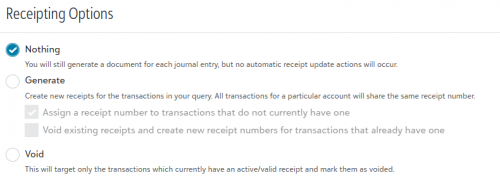

With this merge tag included in your template, the template is saved, and you enter into the Create Documents steps. This feature is now activated and allows you to do one of three things as shown in the image below on Step 3 - Receipting:

By default, this will be set to Nothing. This just means you are printing a document or reprinting a receipt. In the "Generated Receipt Number" merge value, this will either be blank for any transaction not previously receipted or will display the receipt number already assigned to it.

Generate will do just that—generate a receipt number for the transactions in the query selected when you carry through with the Create Documents steps. You will find that Generate gives two options (one or both can be checked). By default, it is set to generate the receipt number for gifts WITHOUT a receipt number. The other option is a Void and Replace option where it will void the original receipt number and replace it with a new number. NOTE: If you wish to do a void and replace with that option, you will want to include the merge tag of Voided Receipt Number as well.

Void simply voids the already-assigned receipt numbers on the gifts in the query. You can later go back and generate new receipt numbers.

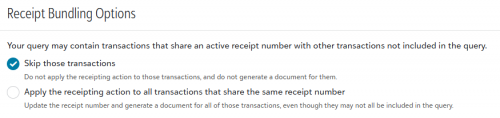

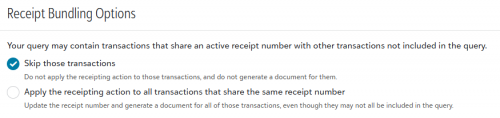

Along with these settings, there are also bundling options at your disposal:

These options are for grouped transactions like recurring gifts or pledge payments. These are available to you at your own discretion and your organization's typical receipting practices.

Outside of this added Receipting step within the Create Documents steps, everything else works like any other document creation option. You have steps to determine what query you are going to use, how the gifts will be grouped, and if you want to use the Auto Mail feature as well.

But, the key thing I wanted to do is provide you with some additional resources to check out.

I hope you have a great 2025. You can expect more eTapestry Webinars and Blog posts from yours truly throughout the year. I plan on revisiting Compound Queries in February before going into the spring with a trio of new topics. Please do not hesitate to comment on other topics you would be interested in seeing as either blog posts or webinars because, as they say, I'm all ears!

Until next time, Happy New Year and keep on eTappin' on!

As you're likely well aware, Canadian tax laws require you to have receipt numbers assigned to each of your charitable gifts and shown on the receipts printed or sent to your donors. To help with this, eTapestry has a feature built into the database called eReceipts. In order to trigger this feature, you must make sure that your communication template includes the Merge Tag for "Generated Receipt Number." It is found in Journal Fields as demonstrated below:

Once it appears in the template's edit step, it will appear as such:

With this merge tag included in your template, the template is saved, and you enter into the Create Documents steps. This feature is now activated and allows you to do one of three things as shown in the image below on Step 3 - Receipting:

By default, this will be set to Nothing. This just means you are printing a document or reprinting a receipt. In the "Generated Receipt Number" merge value, this will either be blank for any transaction not previously receipted or will display the receipt number already assigned to it.

Generate will do just that—generate a receipt number for the transactions in the query selected when you carry through with the Create Documents steps. You will find that Generate gives two options (one or both can be checked). By default, it is set to generate the receipt number for gifts WITHOUT a receipt number. The other option is a Void and Replace option where it will void the original receipt number and replace it with a new number. NOTE: If you wish to do a void and replace with that option, you will want to include the merge tag of Voided Receipt Number as well.

Void simply voids the already-assigned receipt numbers on the gifts in the query. You can later go back and generate new receipt numbers.

Along with these settings, there are also bundling options at your disposal:

These options are for grouped transactions like recurring gifts or pledge payments. These are available to you at your own discretion and your organization's typical receipting practices.

Outside of this added Receipting step within the Create Documents steps, everything else works like any other document creation option. You have steps to determine what query you are going to use, how the gifts will be grouped, and if you want to use the Auto Mail feature as well.

But, the key thing I wanted to do is provide you with some additional resources to check out.

- Generate and Send eReceipts (eTapestry Help Document)

- How to Create a Communications Template (Knowledgebase Article)

- How to Generate a Receipt of Several Transactions Including Voided Ones and Also Create Receipt Numbers for Ones Without It? (Knowledgebase Article)

- Creating Tax Receipts (Canadian Audience) - On Demand eTapestry Webinar

I hope you have a great 2025. You can expect more eTapestry Webinars and Blog posts from yours truly throughout the year. I plan on revisiting Compound Queries in February before going into the spring with a trio of new topics. Please do not hesitate to comment on other topics you would be interested in seeing as either blog posts or webinars because, as they say, I'm all ears!

Until next time, Happy New Year and keep on eTappin' on!

1

Comments

-

Hi Geoff, I clicked on Creating Tax Receipts and it sends me to a registration page for a webinar that has already happened. Is there a recording of the webinar “Creating Tax Receipts (Canadian Audience)" that I can access on demand?

0 -

Hi Betty! If you click on the link and register, you should be allowed to enter the event at that time. It does still look like you are registering for a live event but it's just to access the recording at this point.

0

Categories

- All Categories

- 6 Blackbaud Community Help

- 213 bbcon®

- 1.4K Blackbaud Altru®

- 401 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 1.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- 15 donorCentrics®

- 360 Blackbaud eTapestry®

- 2.6K Blackbaud Financial Edge NXT®

- 655 Blackbaud Grantmaking™

- 576 Blackbaud Education Management Solutions for Higher Education

- 3.2K Blackbaud Education Management Solutions for K-12 Schools

- 939 Blackbaud Luminate Online® and Blackbaud TeamRaiser®

- 84 JustGiving® from Blackbaud®

- 6.6K Blackbaud Raiser's Edge NXT®

- 3.7K SKY Developer

- 248 ResearchPoint™

- 119 Blackbaud Tuition Management™

- 165 Organizational Best Practices

- 241 Member Lounge (Just for Fun)

- 34 Blackbaud Community Challenges

- 34 PowerUp Challenges

- 3 (Open) PowerUp Challenge: Chat for Blackbaud AI

- 3 (Closed) PowerUp Challenge: Data Health

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Product Update Briefing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports+

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Email Marketing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Gift Management

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Event Management

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Home Page

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Query

- 791 Community News

- 2.9K Jobs Board

- 53 Blackbaud SKY® Reporting Announcements

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)