Resources for Producing Tax Letters

Geoff Arbuckle

Blackbaud Employee

Happy New Year! As January blows in, we know organizations in several countries—and especially those in the United States—need to get tax documents in the mail as soon as possible after closing out the year. This blog will provide you with some resources and tips for getting these out to your donors in a timely manner.NOTE: Canadian customers have already had a blog post speaking directly to creating eReceipts. To find that, go here.

Hello again eTappers, Geoff here. Well, another new year is upon us. We amble into the offices after being stuffed with food from the holidays and celebrating New Year's. If you are a college football fan, you might be staying up late to watch primetime Bowl Games. And, I guess, sure... some of us had fun times with family or saw some really good, award-contending movies. But the holidays are all about the food and celebrations, right?

I digress. It's now January. We're back from our time off, and it's time to bemoan the early darkness and cold weather while we get back to work. For nonprofit organizations, that means getting your tax documents prepared and ready to send out. In all my time working with you fine eTapestry users (I can hardly believe that by the end of the year, I will be celebrating 20 years since I first stepped into a role in eTapestry support! Where does the time go?), I have learned how many of you become stressed out because you must get these tax documents out and it adds a little more pressure than you typically see. But I have some good news for you!

Creating tax documents isn't really any different than creating a typical thank-you letter.

Yeah, you read that right. There are really no additional steps to create a tax document than you would do for any other document in eTapestry. You can make them look different if you want and include language that will make them a little more "official" than a general acknowledgment letter, but the steps are pretty much the same. The one key exception to this is for our Canadian friends (if you are reading this in Canada, refer to the NOTE at the top of the page and click that link to check out the resources I have for you there).

To begin with, of course, you will want to start with a query. This query will need to capture pretty much every gift that was received in the previous year. This query can be as simple as setting the Data Return Type to Journal Entries, and then choosing the two criteria under Commonly Used Fields called Individual Transaction Received and Journal Entry Date. For Individual Transaction Received, just set it to "Greater Than or Equal to $1." For Journal Entry Date, fill in the date range you want (e.g., 1/1/2024 to 12/31/2024) or set the drop-down menu to Last Year. The query is all done!

When it comes to creating your document, you have a few options:

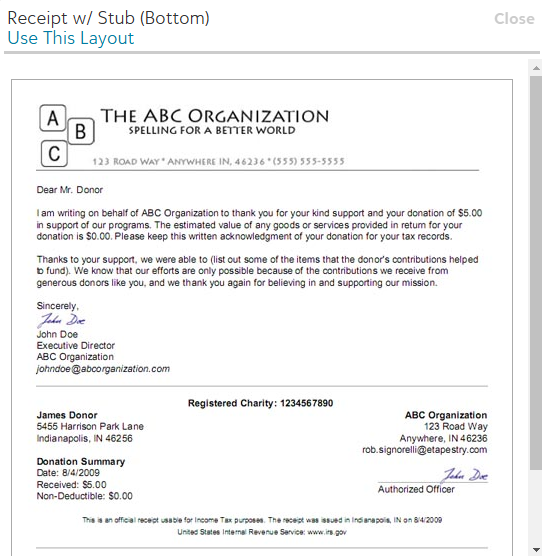

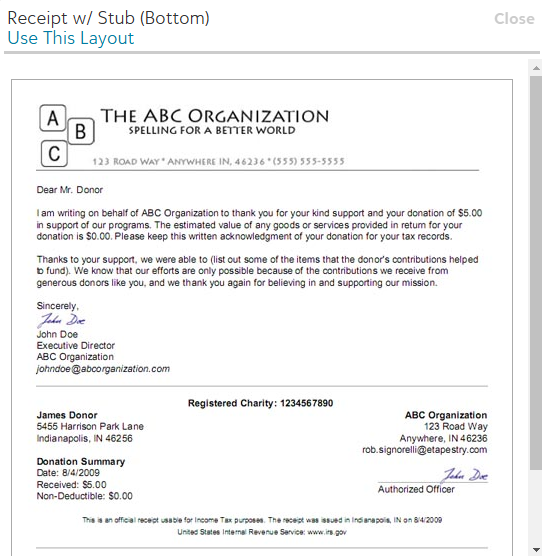

First, you can always just go with the "Simple Business Letter" layout with the Received field accounting for the grand total, and add supporting paragraphs detailing your exciting achievements over the year. Similarly, but a tad more "official" looking, you can use the below layout labeled "Receipt w/Stub" and choose the option with just one stub or multiple stubs.

.

.

This is the same idea, but, as I alluded to, it does come off as a tad more "official" looking.

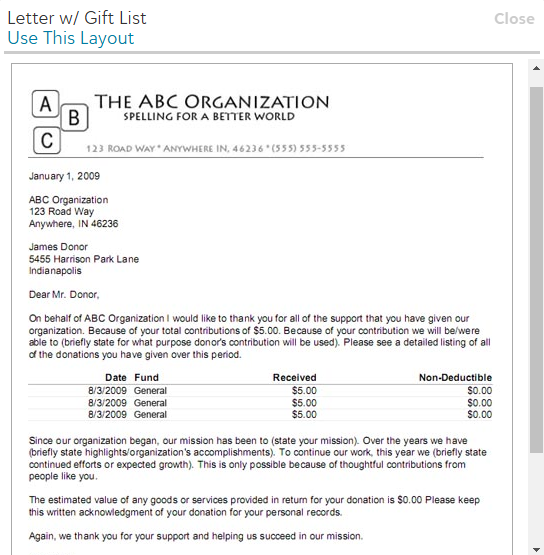

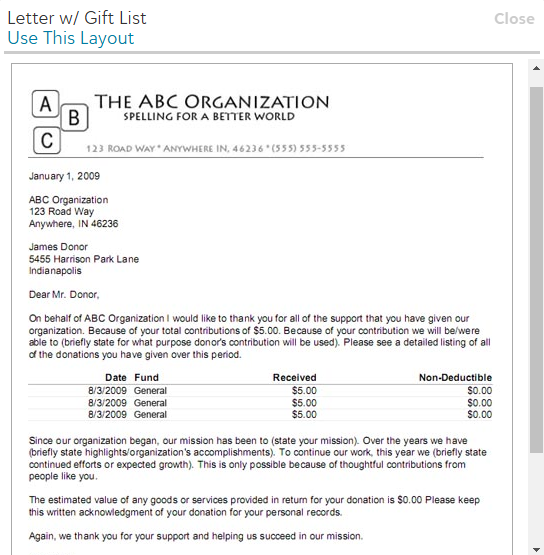

My personal favorite option itemizes all the gifts someone gave throughout the year. That's the one called "Letter w/Gift List."

.

.

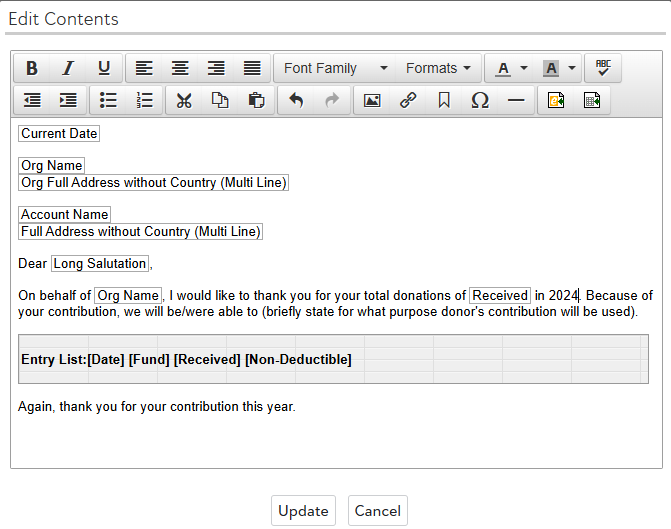

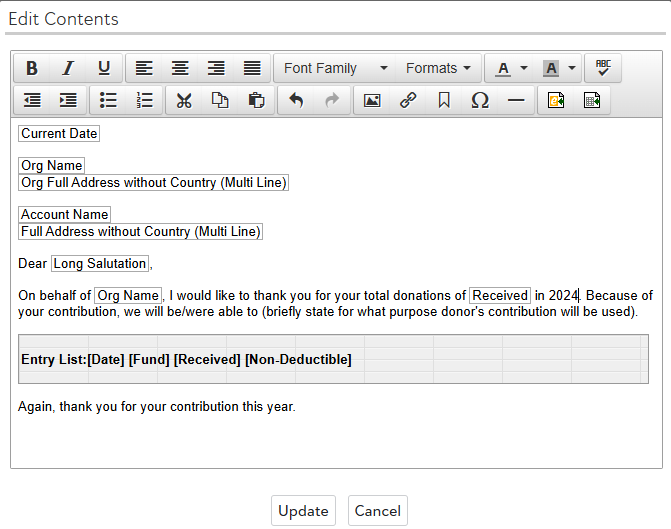

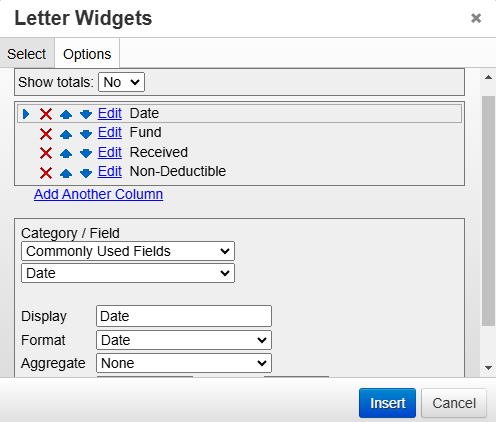

In this, we use what we call a "widget" to insert this table within the letter's layout. You have control over which columns are used (up to 5 total) and how they're totaled. This is done by double-clicking on the widget as it appears on the Edit step as seen below:

.

.

And once you have double-clicked that grey Entry List box, it will open the edit options for that widget:

.

.

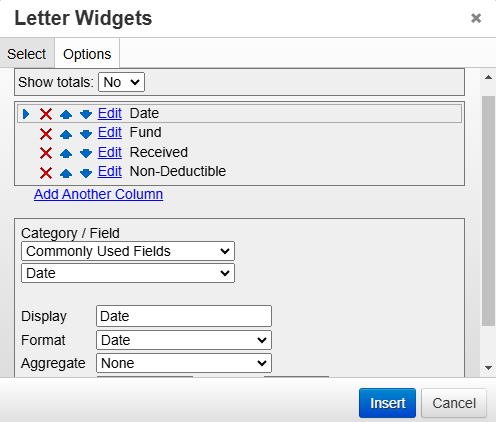

Here you can rearrange, remove, or edit the columns. When you edit one of the columns, you can change the label for that column. So, instead of Received, it could say "Contributed" or some any other phrasing that would resonate with the recipient. As is the case with Reports and Communication Merge Tags, all the fields found in the database will be represented here. By default, it includes Date, Fund, Received, and Non-Deductible. For those of you who use the Non-Deductible field in gifts, I would even go so far as to add the fifth column as "Received Minus Non-Deductible" so it can show the exact tax deductible amount for the donor to use in their tax filing.

Once you have your template created (be it with the gifts list, the stub, the general business letter, or another layout altogether), the process to Create Documents is the same as any other acknowledgment: select your query, choose how you want this to be grouped (I strongly recommend grouping the letters to be "One Document per Account"), and if you want to utilize the Auto Mail feature to send these out via email for those whose emails you have. Nothing really changes about this process as a whole and that should, hopefully, help alleviate some of the stress about getting these tax documents out.

But, as promised, I do have some resources for you. These should also be of use to you with step-by-step directions and more.

Until next time, Happy New Year and keep on eTappin' on!

Hello again eTappers, Geoff here. Well, another new year is upon us. We amble into the offices after being stuffed with food from the holidays and celebrating New Year's. If you are a college football fan, you might be staying up late to watch primetime Bowl Games. And, I guess, sure... some of us had fun times with family or saw some really good, award-contending movies. But the holidays are all about the food and celebrations, right?

I digress. It's now January. We're back from our time off, and it's time to bemoan the early darkness and cold weather while we get back to work. For nonprofit organizations, that means getting your tax documents prepared and ready to send out. In all my time working with you fine eTapestry users (I can hardly believe that by the end of the year, I will be celebrating 20 years since I first stepped into a role in eTapestry support! Where does the time go?), I have learned how many of you become stressed out because you must get these tax documents out and it adds a little more pressure than you typically see. But I have some good news for you!

Creating tax documents isn't really any different than creating a typical thank-you letter.

Yeah, you read that right. There are really no additional steps to create a tax document than you would do for any other document in eTapestry. You can make them look different if you want and include language that will make them a little more "official" than a general acknowledgment letter, but the steps are pretty much the same. The one key exception to this is for our Canadian friends (if you are reading this in Canada, refer to the NOTE at the top of the page and click that link to check out the resources I have for you there).

To begin with, of course, you will want to start with a query. This query will need to capture pretty much every gift that was received in the previous year. This query can be as simple as setting the Data Return Type to Journal Entries, and then choosing the two criteria under Commonly Used Fields called Individual Transaction Received and Journal Entry Date. For Individual Transaction Received, just set it to "Greater Than or Equal to $1." For Journal Entry Date, fill in the date range you want (e.g., 1/1/2024 to 12/31/2024) or set the drop-down menu to Last Year. The query is all done!

When it comes to creating your document, you have a few options:

First, you can always just go with the "Simple Business Letter" layout with the Received field accounting for the grand total, and add supporting paragraphs detailing your exciting achievements over the year. Similarly, but a tad more "official" looking, you can use the below layout labeled "Receipt w/Stub" and choose the option with just one stub or multiple stubs.

.

.

This is the same idea, but, as I alluded to, it does come off as a tad more "official" looking.

My personal favorite option itemizes all the gifts someone gave throughout the year. That's the one called "Letter w/Gift List."

.

.

In this, we use what we call a "widget" to insert this table within the letter's layout. You have control over which columns are used (up to 5 total) and how they're totaled. This is done by double-clicking on the widget as it appears on the Edit step as seen below:

.

.

And once you have double-clicked that grey Entry List box, it will open the edit options for that widget:

.

.

Here you can rearrange, remove, or edit the columns. When you edit one of the columns, you can change the label for that column. So, instead of Received, it could say "Contributed" or some any other phrasing that would resonate with the recipient. As is the case with Reports and Communication Merge Tags, all the fields found in the database will be represented here. By default, it includes Date, Fund, Received, and Non-Deductible. For those of you who use the Non-Deductible field in gifts, I would even go so far as to add the fifth column as "Received Minus Non-Deductible" so it can show the exact tax deductible amount for the donor to use in their tax filing.

Once you have your template created (be it with the gifts list, the stub, the general business letter, or another layout altogether), the process to Create Documents is the same as any other acknowledgment: select your query, choose how you want this to be grouped (I strongly recommend grouping the letters to be "One Document per Account"), and if you want to utilize the Auto Mail feature to send these out via email for those whose emails you have. Nothing really changes about this process as a whole and that should, hopefully, help alleviate some of the stress about getting these tax documents out.

But, as promised, I do have some resources for you. These should also be of use to you with step-by-step directions and more.

- How to Create a Year-End Query (Knowledgebase Article)

- How to Create a Communications Template (Knowledgebase Article)

- Use Query to Generate Documents in Bulk (eTapestry Help Document)

- Creating Tax Documents (On-Demand Webinar)

Until next time, Happy New Year and keep on eTappin' on!

0

Categories

- All Categories

- 6 Blackbaud Community Help

- 209 bbcon®

- 1.4K Blackbaud Altru®

- 394 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 1.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- 15 donorCentrics®

- 359 Blackbaud eTapestry®

- 2.5K Blackbaud Financial Edge NXT®

- 646 Blackbaud Grantmaking™

- 563 Blackbaud Education Management Solutions for Higher Education

- 3.2K Blackbaud Education Management Solutions for K-12 Schools

- 934 Blackbaud Luminate Online® and Blackbaud TeamRaiser®

- 84 JustGiving® from Blackbaud®

- 6.4K Blackbaud Raiser's Edge NXT®

- 3.7K SKY Developer

- 243 ResearchPoint™

- 118 Blackbaud Tuition Management™

- 165 Organizational Best Practices

- 238 The Tap (Just for Fun)

- 33 Blackbaud Community Challenges

- 28 PowerUp Challenges

- 3 (Open) Raiser's Edge NXT PowerUp Challenge: Product Update Briefing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports+

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Email Marketing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Gift Management

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Event Management

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Home Page

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Query

- 779 Community News

- 2.9K Jobs Board

- 53 Blackbaud SKY® Reporting Announcements

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)