Is Your VCO/Report Complete? Yes, You Need Validation!

Published

If you are new to Financial Edge, or even if you aren't and just stepped into a database that was already set up for you, you may not be familiar with the situation where you need a VCO as a basis for any report you are running. Well I hope to address some of that with this article as well as share some tips and tricks for you.

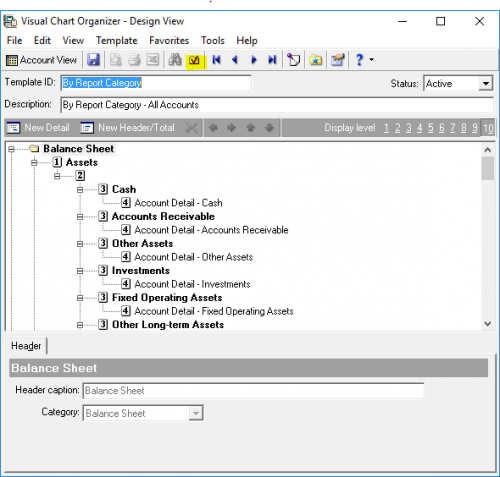

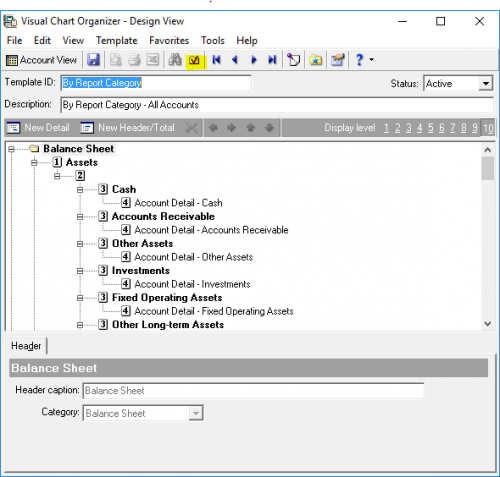

The VCO is the backbone of every Financial Report you wish to run. It is what organizes your financial activity into groupings such as Cash and Cash Equivalents vs. Fixed Assets, or Salaries and Benefits versus Utilities. You can utilize a variety of filters for each line or section of your VCO, whether it is account numbers, project or grant codes, attributes, etc. You can have as many different VCOs as you need but you can use a VCO for as many reports as you want. For example, you may have a VCO for your internal financials and a separate VCO that you use to produce your FASB/GASB formatted statements. Yes...you can do that! Think of the VCO as the skeleton and the report as the outfit. You can put different oufits (reports) over the same skeleton.

The key to any VCO is to make sure that it is complete and includes all of your financial information, assuming you have not built a VCO to specifically exclude certain info. I don't recommend this. I prefer to have a complete VCO and create limits in my specific report utilizing filters. There is a special functionality in FE that allows you to check and verify that a VCO is in fact complete. It is the validation button:

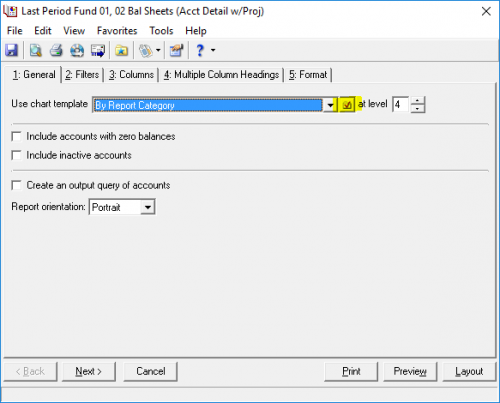

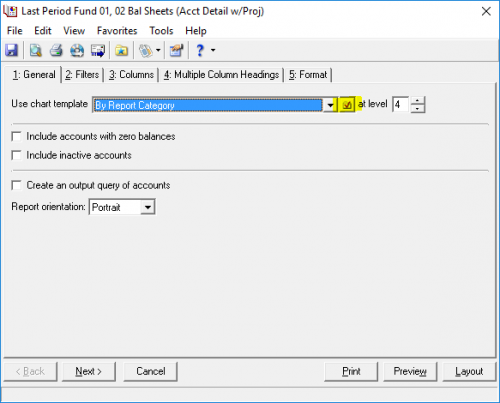

When you click on this button it will produce a validation report that will indicate any missing or duplicated accounts. The missing accounts are important as if there is any financial information associated with them, your financial report would not reflect it. A duplicated account is not necessarily bad if you have used a different characteristic such as project code to define multiple lines of information. You can also validate your VCO from the report that is using it:

Now I will point out at this time that even if your VCO validates as complete, does not necessarily mean that it is accurate. Specifically if you have used a characteristic other than just the account number/code, such as project code, it is possible to miss a bucket of information in your financial reports. What if you failed to account for a particular project code? Unfortunately the VCO validation process does not account for all of these possibilities. But herein lies a litte trick for you.

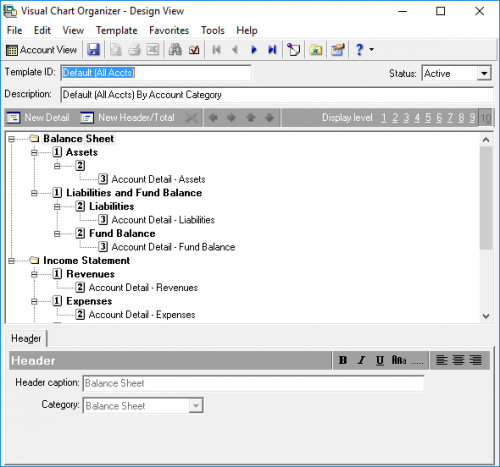

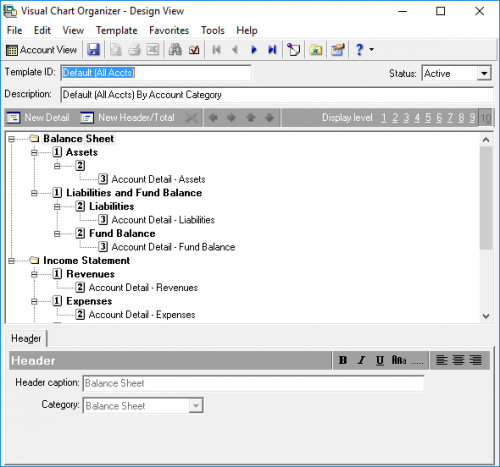

It is the Default VCO. By definition the Default VCO should not be formatted in any substantial manner. It should look something like this so that it is all inclusive:

Now here is the trick. Open your Financial Report and change the VCO to be used to the Default VCO. Run the report to see the bottom line results. Now change the VCO selection back to your chosen, formatted VCO and run the report. If you don't get the same bottom line results (total income/expenses/assets/liabilities/net assets) then there is potentially something wrong with your formatted VCO.

I hope this has helped you avoid embarassing results from presenting inaccurate Financial Reports. Feel free to message me with any questions. If you don't have much experience with building VCOs and Reports, I encourage you to take one of our Training courses or you can engage someone like myself to work with you to build them for you.

The VCO is the backbone of every Financial Report you wish to run. It is what organizes your financial activity into groupings such as Cash and Cash Equivalents vs. Fixed Assets, or Salaries and Benefits versus Utilities. You can utilize a variety of filters for each line or section of your VCO, whether it is account numbers, project or grant codes, attributes, etc. You can have as many different VCOs as you need but you can use a VCO for as many reports as you want. For example, you may have a VCO for your internal financials and a separate VCO that you use to produce your FASB/GASB formatted statements. Yes...you can do that! Think of the VCO as the skeleton and the report as the outfit. You can put different oufits (reports) over the same skeleton.

The key to any VCO is to make sure that it is complete and includes all of your financial information, assuming you have not built a VCO to specifically exclude certain info. I don't recommend this. I prefer to have a complete VCO and create limits in my specific report utilizing filters. There is a special functionality in FE that allows you to check and verify that a VCO is in fact complete. It is the validation button:

When you click on this button it will produce a validation report that will indicate any missing or duplicated accounts. The missing accounts are important as if there is any financial information associated with them, your financial report would not reflect it. A duplicated account is not necessarily bad if you have used a different characteristic such as project code to define multiple lines of information. You can also validate your VCO from the report that is using it:

Now I will point out at this time that even if your VCO validates as complete, does not necessarily mean that it is accurate. Specifically if you have used a characteristic other than just the account number/code, such as project code, it is possible to miss a bucket of information in your financial reports. What if you failed to account for a particular project code? Unfortunately the VCO validation process does not account for all of these possibilities. But herein lies a litte trick for you.

It is the Default VCO. By definition the Default VCO should not be formatted in any substantial manner. It should look something like this so that it is all inclusive:

Now here is the trick. Open your Financial Report and change the VCO to be used to the Default VCO. Run the report to see the bottom line results. Now change the VCO selection back to your chosen, formatted VCO and run the report. If you don't get the same bottom line results (total income/expenses/assets/liabilities/net assets) then there is potentially something wrong with your formatted VCO.

I hope this has helped you avoid embarassing results from presenting inaccurate Financial Reports. Feel free to message me with any questions. If you don't have much experience with building VCOs and Reports, I encourage you to take one of our Training courses or you can engage someone like myself to work with you to build them for you.

News

ARCHIVED | Financial Edge® Tips and Tricks

02/15/2018 8:45am EST

Leave a Comment

https://kb.blackbaud.com/articles/Article/44349

I have a question on a related topic - is there a way to print the VCOs we have developed, so we can see what accounts are grouped together, etc.?