What's New(er): Configure Revenue Received And Committed!

**Updating this blog post with a heads up on a fairly recent discussion thread on this feature. How is your organization using the revenue type settings? Which gift types are you counting as received or committed revenue? Chime in on the thread to discuss!**

Recently, Raiser's Edge NXT updated with a new Revenue type filter, which you can use to choose whether to analyze giving in context of revenue cash-in-door or the total commitment to your fundraising efforts. Earlier today, Raiser's Edge NXT released the next evolution: The ability for your organization to configure which types of gifts to consider when calculating both revenue received and committed!

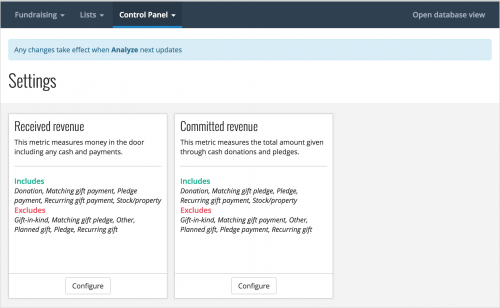

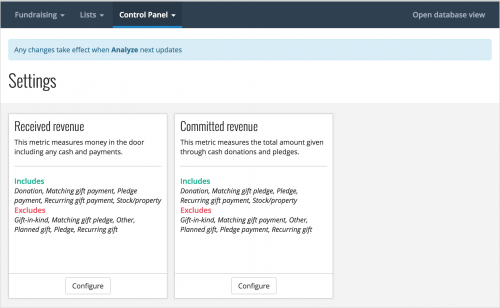

To set up these revenue types, admins can now select Control Panel, Settings and configure the global settings for each.

To set up these revenue types, admins can now select Control Panel, Settings and configure the global settings for each.

Received revenue. To focus on cash-in-hand giving, such as for accounting totals, received revenue always includes donations and payments toward pledges, matching gifts, recurring gifts, and planned or legacy gifts. With the new settings, your organization can now choose whether to also include gifts-in-kind, stock/property, or gifts of Other.

To avoid double-counting, received revenue doesn't include pledges, matching gifts, recurring gifts, planned gifts, or soft credits.

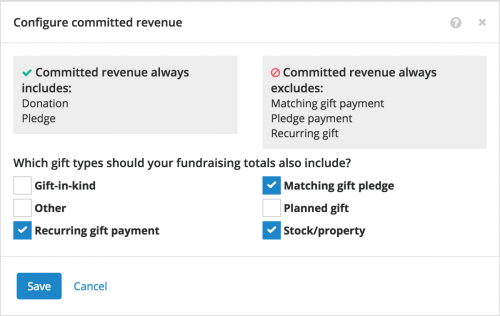

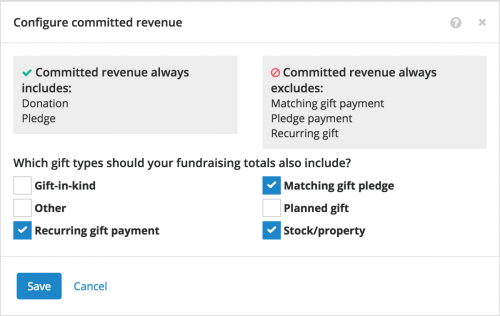

Committed revenue. To focus on the commitment toward your fundraising efforts, committed revenue always includes donations and pledges. With the new settings, your organization can now choose whether to include:

Committed revenue. To focus on the commitment toward your fundraising efforts, committed revenue always includes donations and pledges. With the new settings, your organization can now choose whether to include:

Any changes you make to these settings take effect when Analyze next updates.

For more information, check out the Revenue Types Help.

Recently, Raiser's Edge NXT updated with a new Revenue type filter, which you can use to choose whether to analyze giving in context of revenue cash-in-door or the total commitment to your fundraising efforts. Earlier today, Raiser's Edge NXT released the next evolution: The ability for your organization to configure which types of gifts to consider when calculating both revenue received and committed!

To set up these revenue types, admins can now select Control Panel, Settings and configure the global settings for each.

To set up these revenue types, admins can now select Control Panel, Settings and configure the global settings for each.Received revenue. To focus on cash-in-hand giving, such as for accounting totals, received revenue always includes donations and payments toward pledges, matching gifts, recurring gifts, and planned or legacy gifts. With the new settings, your organization can now choose whether to also include gifts-in-kind, stock/property, or gifts of Other.

To avoid double-counting, received revenue doesn't include pledges, matching gifts, recurring gifts, planned gifts, or soft credits.

Committed revenue. To focus on the commitment toward your fundraising efforts, committed revenue always includes donations and pledges. With the new settings, your organization can now choose whether to include:

Committed revenue. To focus on the commitment toward your fundraising efforts, committed revenue always includes donations and pledges. With the new settings, your organization can now choose whether to include:

- Recurring gift payments

- Matching gift pledges

- Planned or legacy gifts

- Gifts-in-kind

- Stock/property

- Gifts of Other

Any changes you make to these settings take effect when Analyze next updates.

For more information, check out the Revenue Types Help.

0

Comments

-

This is a great new feature and will make a big difference! Thanks for continue to fine-tune Sky Reporting!

Something to consider:

In RE there is a bit more configuration options on summarizing amounts "Committed". We have calculated our totals by adding:

- all cash gifts and payments

- pledge BALANCE

- write-offs.

Two questions on this topic:

1) In this update, you mentioned "With the new settings, your organization can now choose whether to subtract write-offs." I don't see a checkbox or mention of write-offs on the Committed revenue settings.

2) Would be great to have a configuration option to include pledges (but to check only include pledge balances). Since RE gift entry functions allows you to apply a payment from one campaign, fund, or appeal against a different campaign, fund, or appeal. This means your total pledge amount per fund might not match your total payments per fund.0 -

Hey Blake! My bad on write-offs, thanks for pointing that out. They may be a setting for future "fine-tuning" (blog post updated accordingly). Feel free to add them and the additional configuration options you mention to the Idea Bank to help us gauge which to focus on first. Thanks!0

-

This is nice, but I would LOVE gift subtype as well!!0

-

That's great feedback, Karen! I suggest adding it to the Idea Bank to help guide future iterations of this feature: https://community.blackbaud.com/products/raisersedgenxt/ideas Thanks!0

-

This is a great start, but we would like to see Stock/Property (Sold) as an option. After we process the Stock Gift in batch, we then go into the gift and "Sell" it recording the sold amount. When we sell the gift RE automatically changes the gift type from Stock/Property to Stock/Property (Sold). Now my gift totals for Commitments do not match in Database view and NXT because in Database view we are correctly pulling the Stock/Property (Sold) gift type. I am curious, has anyone else faced this issue?0

-

Hey Ronald- When you select to include Stock/property gifts in a revenue type, it includes both sold and unsold gifts in its counts, but it only considers the amounts and dates of the original (unsold) gifts, which may explain the discrepancy you're seeing (assuming you're looking to use the sold amount). If that's the case, you may want to throw your vote to this similar idea in the Idea Bank: https://renxt.ideas.aha.io/ideas/RENXT-I-526. We'll also update the Revenue Types Help to clarify how the Stock/property option currently affects the calculations. Thanks for bringing this up!0

Categories

- All Categories

- 6 Blackbaud Community Help

- 213 bbcon®

- 1.4K Blackbaud Altru®

- 403 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 1.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- 15 donorCentrics®

- 360 Blackbaud eTapestry®

- 2.6K Blackbaud Financial Edge NXT®

- 656 Blackbaud Grantmaking™

- 576 Blackbaud Education Management Solutions for Higher Education

- 3.2K Blackbaud Education Management Solutions for K-12 Schools

- 939 Blackbaud Luminate Online® and Blackbaud TeamRaiser®

- 84 JustGiving® from Blackbaud®

- 6.6K Blackbaud Raiser's Edge NXT®

- 3.7K SKY Developer

- 248 ResearchPoint™

- 119 Blackbaud Tuition Management™

- 165 Organizational Best Practices

- 241 Member Lounge (Just for Fun)

- 34 Blackbaud Community Challenges

- 34 PowerUp Challenges

- 3 (Open) PowerUp Challenge: Chat for Blackbaud AI

- 3 (Closed) PowerUp Challenge: Data Health

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Product Update Briefing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports+

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Email Marketing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Gift Management

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Event Management

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Home Page

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Query

- 794 Community News

- 2.9K Jobs Board

- 54 Blackbaud SKY® Reporting Announcements

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)