Matching Gifts: Doubling Up on Donations

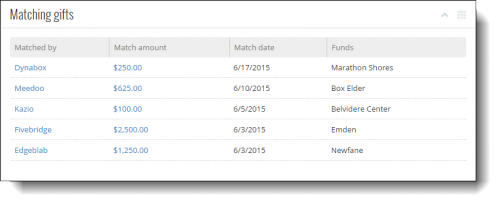

Many corporations — around 65% of Fortune 500 companies — offer matching gift programs, where they match employees' donations to eligible nonprofits. On a gift's record in Raiser's Edge NXT, you can view information about any related corporate giving under Matching gifts. For each matching gift, you can view its corporate donor, how much was pledged or received (and when), and which fund it applied to.

Many corporations — around 65% of Fortune 500 companies — offer matching gift programs, where they match employees' donations to eligible nonprofits. On a gift's record in Raiser's Edge NXT, you can view information about any related corporate giving under Matching gifts. For each matching gift, you can view its corporate donor, how much was pledged or received (and when), and which fund it applied to.With matching gifts, your organization can maximize your constituents' giving with free additional donations. (Well, essentially free, as fundraising through matching gifts does require some legwork!) To get the most of your matching gifts, consider these best practices.

Track your donors' employment information. As nearly one in 10 donors work for companies that match charitable gifts, your constituents' employers are important details to track. On a constituent's record, you can view their primary business relationship under Constituent summary. To get this information, simply ask donors through interactions, donation forms, event registration forms, and so on. You can also collect business cards or infer employment based on business email addresses. Research your donors' employers to determine which offer matching gift programs and the parameters of each.

Remind donors about matching gifts (again and again). Mention matching gifts during phone solicitations, and include reminders about them in your appeals, acknowledgements, and receipts. If a donor indicates that their employer has a matching gift program, ask that they submit any matching gift requests to the company, and then track the request as a matching gift pledge to ensure its fulfillment. If you need to follow up on a matching gift request, discuss it directly with the corporation rather than the donor of the original gift.

Thank your matching gift donors (both of them). As matching gifts are a way to double donations, be prepared to double (or triple) your gratitude as well. Thank the donor of the original, matched gift twice; once for their personal donation, and again when you receive the matching gift payment from their employer. Be sure to also thank the company for their matching gift, and look for opportunities to cultivate a relationship with them for future corporate giving. Consider special events to honor matching gift donors as further thanks for their help in doubling their donation, and to help raise awareness of matching gifts in general.

Analyze your fundraising through matching gifts. As with all your fundraising efforts, it's important to track the effectiveness of your matching gifts and look for areas to improve. Compare how much you raise through matching gift payments year-over-year, track the time and effort involved in acquiring matching gifts, and identify which corporations donate the most matching gifts. To quickly determine a donor's cumulative impact, you can view a summary of matching gifts received and pledged based on their gifts under Giving on their constituent record.

For more information about matching gift information in Raiser's Edge NXT, see the Matching Gifts Help.

0

Categories

- All Categories

- 6 Blackbaud Community Help

- 213 bbcon®

- 1.4K Blackbaud Altru®

- 403 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 1.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- 15 donorCentrics®

- 360 Blackbaud eTapestry®

- 2.6K Blackbaud Financial Edge NXT®

- 656 Blackbaud Grantmaking™

- 577 Blackbaud Education Management Solutions for Higher Education

- 3.2K Blackbaud Education Management Solutions for K-12 Schools

- 939 Blackbaud Luminate Online® and Blackbaud TeamRaiser®

- 84 JustGiving® from Blackbaud®

- 6.6K Blackbaud Raiser's Edge NXT®

- 3.7K SKY Developer

- 248 ResearchPoint™

- 119 Blackbaud Tuition Management™

- 165 Organizational Best Practices

- 241 Member Lounge (Just for Fun)

- 34 Blackbaud Community Challenges

- 37 PowerUp Challenges

- 3 (Open) PowerUp Challenge: Grid View Batch

- 3 (Closed) PowerUp Challenge: Chat for Blackbaud AI

- 3 (Closed) PowerUp Challenge: Data Health

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Product Update Briefing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports+

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Email Marketing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Gift Management

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Event Management

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Home Page

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Query

- 794 Community News

- 2.9K Jobs Board

- 54 Blackbaud SKY® Reporting Announcements

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)