Wealth Indicators from WealthPoint screening in ResearchPoint

Kate Breck

Blackbaud Employee

As prospect researchers, we emphasize the results from hard asset data sources - real estate, public company stock, and private company equity - the industry-standard measures of capacity. But what if the WealthPoint screening in ResearchPoint was unable to find information about one of your prospects? Are you aware "Wealth Indicators" could point you towards hidden wealth?Did you know there is a hidden wealth indicator included in the WealthPoint data sources?

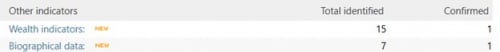

You may have noticed on the left-hand side of an individual's wealth summary record in ResearchPoint lists "Wealth indicators" - Total identified and Confirmed.

The source for that data is a marketing database used by financial firms, hedge fund managers and Wall Street to prospect for cold calls - Larkspur Data.

It's possible you've never heard of Larkspur Data - and that's because their primary consumers are financial professionals that purchase targeted data and market intelligence from them to expand their sales. Larkspur Data's Prospects of Wealth database has isolated millions of high-net-worth individuals in the United States using alternative identification methods than traditional capacity markets of real estate, public company stock and private company equity.

According to an IRS study on Personal Wealth, individuals with a net worth greater than $5 Million have asset holdings spread out among many asset categories. The assets most commonly found through wealth screenings are personal residences and other real estate. Occasionally, publicly traded stock, direct and indirect holdings, and business assets can be identified. And typically, cash, retirement assets, and other financial assets (such as diversified mutual funds, cash value life insurance, or annuities) are well-hidden from public domain research efforts.

And yet, a hedge fund manager needs to identify high-capacity prospects - and the Forbes list isn't a reliable way to find the names of millionaires-next-door. Just like I turned to a direct marketing firm locally to build a prospect list of potential new members for the newly built South Carolina Aquarium when I was a development officer, financial brokers on Wall Street are turning to Larkspur Data returns to build a prospect list.

Here's a quick run-down of how Larkspur Data has built their database:

To isolate America's elite, they have tapped into over 70 diverse sources to assemble an extensive repository of names of the wealthiest households. The sources include Coast Guard yacht registrations, the FAA registry of private aircraft owners, and financial records of corporate insiders acquired through Rule 144 filings. This effort resulted in an initial database of millions of affluent individuals featuring "markers" of wealth.

Next, they have a rigorous refinement process to exclude individuals who may not meet the criteria for substantial wealth - to present exclusively the most promising prospects. For inclusion, individuals are required to exhibit multiple distinct indicators (markers) of wealth. This comprehensive approach has resulted in a highly selective dataset.

Finally, because accuracy is paramount, the database undergoes meticulous cross-verification to uphold its integrity. This includes the validation of postal codes using the US Postal Services' National Change of Address (NCOA) database. When you are providing elite names to Wall Street for cold calling, if the names weren't of value, you'd be out of business quickly.

As prospect researchers and fundraisers, we can use these wealth indicators as "red flags" - a sign that we should take another look at a prospect who might be hiding traditional wealth through trusts, accountants, or offshore accounts.

This Blackbaud Knowledgebase provides a list of some common Larkspur Data returns - the Wealth Indicators that the financial professionals are using to select names from the database. When you are working with these returns, think with a "financial lens". When I asked my local direct mail house for names of potential members for the aquarium, I requested "markers" that would indicate affinity and capacity to be a member - the presence of children under 18, a minimum household income level, etc. Larkspur Data is working similarly, but from a financial lens.

Financial markers can include -

Hopefully this demystified the Wealth Indicators for you. I've found Larkspur Data to be an underused resource within the wealth returns. Happy hidden wealth hunting!

You may have noticed on the left-hand side of an individual's wealth summary record in ResearchPoint lists "Wealth indicators" - Total identified and Confirmed.

The source for that data is a marketing database used by financial firms, hedge fund managers and Wall Street to prospect for cold calls - Larkspur Data.

It's possible you've never heard of Larkspur Data - and that's because their primary consumers are financial professionals that purchase targeted data and market intelligence from them to expand their sales. Larkspur Data's Prospects of Wealth database has isolated millions of high-net-worth individuals in the United States using alternative identification methods than traditional capacity markets of real estate, public company stock and private company equity.

According to an IRS study on Personal Wealth, individuals with a net worth greater than $5 Million have asset holdings spread out among many asset categories. The assets most commonly found through wealth screenings are personal residences and other real estate. Occasionally, publicly traded stock, direct and indirect holdings, and business assets can be identified. And typically, cash, retirement assets, and other financial assets (such as diversified mutual funds, cash value life insurance, or annuities) are well-hidden from public domain research efforts.

And yet, a hedge fund manager needs to identify high-capacity prospects - and the Forbes list isn't a reliable way to find the names of millionaires-next-door. Just like I turned to a direct marketing firm locally to build a prospect list of potential new members for the newly built South Carolina Aquarium when I was a development officer, financial brokers on Wall Street are turning to Larkspur Data returns to build a prospect list.

Here's a quick run-down of how Larkspur Data has built their database:

To isolate America's elite, they have tapped into over 70 diverse sources to assemble an extensive repository of names of the wealthiest households. The sources include Coast Guard yacht registrations, the FAA registry of private aircraft owners, and financial records of corporate insiders acquired through Rule 144 filings. This effort resulted in an initial database of millions of affluent individuals featuring "markers" of wealth.

Next, they have a rigorous refinement process to exclude individuals who may not meet the criteria for substantial wealth - to present exclusively the most promising prospects. For inclusion, individuals are required to exhibit multiple distinct indicators (markers) of wealth. This comprehensive approach has resulted in a highly selective dataset.

Finally, because accuracy is paramount, the database undergoes meticulous cross-verification to uphold its integrity. This includes the validation of postal codes using the US Postal Services' National Change of Address (NCOA) database. When you are providing elite names to Wall Street for cold calling, if the names weren't of value, you'd be out of business quickly.

As prospect researchers and fundraisers, we can use these wealth indicators as "red flags" - a sign that we should take another look at a prospect who might be hiding traditional wealth through trusts, accountants, or offshore accounts.

This Blackbaud Knowledgebase provides a list of some common Larkspur Data returns - the Wealth Indicators that the financial professionals are using to select names from the database. When you are working with these returns, think with a "financial lens". When I asked my local direct mail house for names of potential members for the aquarium, I requested "markers" that would indicate affinity and capacity to be a member - the presence of children under 18, a minimum household income level, etc. Larkspur Data is working similarly, but from a financial lens.

Financial markers can include -

- Accredited Investor: Typically has high net worth or relevant professional certifications, considered wealthy and financially sophisticated enough to invest in certain high-risk securities, allowed to invest in private securities offerings not registered with the SEC.

- Diversified Investor: Diverse portfolios in both conservative areas such as bonds and CDs but also more speculative areas such as High Tech

- Speculative Investor: Portfolios in riskier commodities such as Tech Funds, IPOs, Penny Stocks

- Investor-Estate Planning, Investor-Retirement Planning: Great indicators for prospects for legacy giving

- Aircraft Owners: from FAA registration records

- Yacht Owners: Coast Guard registry

- Horse Owners/Breeders, Thoroughbred Owners: State and county records

- Interest Golf: Members at exclusive golf courses

- Home Decor: Purchase regularly from art and auction houses (registrations for bidding)

- Wine & Gourmet: Memberships to exclusive vineyards, producing limited edition bottles

Hopefully this demystified the Wealth Indicators for you. I've found Larkspur Data to be an underused resource within the wealth returns. Happy hidden wealth hunting!

5

Comments

-

Great information!

0 -

Agreed Steffanie, great information. Thank you Kate!

0

Categories

- All Categories

- 6 Blackbaud Community Help

- 213 bbcon®

- 1.4K Blackbaud Altru®

- 402 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 1.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- 15 donorCentrics®

- 360 Blackbaud eTapestry®

- 2.6K Blackbaud Financial Edge NXT®

- 656 Blackbaud Grantmaking™

- 576 Blackbaud Education Management Solutions for Higher Education

- 3.2K Blackbaud Education Management Solutions for K-12 Schools

- 939 Blackbaud Luminate Online® and Blackbaud TeamRaiser®

- 84 JustGiving® from Blackbaud®

- 6.6K Blackbaud Raiser's Edge NXT®

- 3.7K SKY Developer

- 248 ResearchPoint™

- 119 Blackbaud Tuition Management™

- 165 Organizational Best Practices

- 241 Member Lounge (Just for Fun)

- 34 Blackbaud Community Challenges

- 34 PowerUp Challenges

- 3 (Open) PowerUp Challenge: Chat for Blackbaud AI

- 3 (Closed) PowerUp Challenge: Data Health

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Product Update Briefing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports+

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Email Marketing

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Gift Management

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Event Management

- 3 (Closed) Raiser's Edge NXT PowerUp Challenge: Home Page

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Standard Reports

- 4 (Closed) Raiser's Edge NXT PowerUp Challenge: Query

- 793 Community News

- 2.9K Jobs Board

- 54 Blackbaud SKY® Reporting Announcements

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)